Indian Commercial Vehicle Industry

- 2. Contents Commercial Vehicles – An Overview Objective of the Analysis Preliminary Analysis of CV Pools – All Originators Preliminary Analysis of CV Pools – Only AU Financiers Ltd. Detailed Analysis of CV Pools – All Originators Market Outlook Conclusion

- 3. Commercial Vehicles – An Overview

- 4. Commercial Vehicles What is a Commercial Vehicle (CV)? A Commercial vehicle is a type of motor vehicle that may be used for transporting goods or passenger. Importance on CV Industry in India Trucks can access remote and hilly areas where rail lines cannot be constructed. The CV industry enables quick, easy departure of goods and accepts smaller loads than railways. The industry has captured short-haul goods transport and a major chunk of long-haul goods transport where quick delivery from railways is essential. Major Classification of CV Industry Light Commercial Vehicle (LCV) – Goods & Carriage Vehicle with light capacity with Minimum Permissible Capacity (MPC) of 7 – 11 tons Medium Commercial Vehicle (MCV) – Single Axle Vehicle used mainly for the carriage of perishable goods with MPC of 16 tons of Mass Heavy Commercial Vehicle (HCV) – Dingle Axle Vehicle used mainly for the carriage of non-perishable goods with MPC of 17 to 25 tons of Mass Major CV Financiers in India Cholamandalam Finance, Sundaram Finance, AU Finance, Shriram Transport Finance, Magma, L&T, M&M, Religare, Tata Motors, Reliance

- 5. Objective of the Analysis

- 6. Objectives Identify the factors which significantly affect the pool performance (delinquencies) Illustrate the way in which these factors affect the delinquencies

- 7. Preliminary Analysis of CV Pools – All Originators

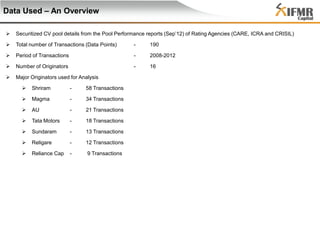

- 8. Data Used – An Overview Securitized CV pool details from the Pool Performance reports (Sep’12) of Rating Agencies (CARE, ICRA and CRISIL) Total number of Transactions (Data Points) - 190 Period of Transactions - 2008-2012 Number of Originators - 16 Major Originators used for Analysis Shriram - 58 Transactions Magma - 34 Transactions AU - 21 Transactions Tata Motors - 18 Transactions Sundaram - 13 Transactions Religare - 12 Transactions Reliance Cap - 9 Transactions

- 9. Collection Details & Methodology Used Parameters Collected for Analysis: Transaction Details : Transaction month, Transaction Name, Originator, Transaction Structure, Type of Transaction, Rating Assigned for Seniors and Junior Initial Pool Details : Pool Principal, Pool Composition, Credit Enhancement (% of Initial POS), EIS (% of Initial POS) Pool Performance Details : Cumulative Collection Efficiency (CCE) Methodology Used: Collection of data from the Pool Performance (Sep’ 12) reports of Rating Agencies Identification of factors, which are to be used for the analysis of transactions Regression Analysis of these factors with respect Sep’12 CCE and Scatter plots to capture trends Observe the significance level of factors which affects CCE

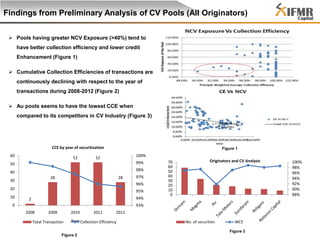

- 10. Findings from Preliminary Analysis of CV Pools (All Originators) Pools having greater NCV Exposure (>40%) tend to have better collection efficiency and lower credit Enhancement (Figure 1) Cumulative Collection Efficiencies of transactions are continuously declining with respect to the year of transactions during 2008-2012 (Figure 2) Au pools seems to have the lowest CCE when compared to its competitors in CV Industry (Figure 3) CCE by year of securitization 60 52 Figure 1 100% 52 99% 50 98% 40 28 30 28 96% 20 10 97% 95% 94% 2 0 70 60 50 40 30 20 10 0 Originators and CV Analysis 93% 2008 2009 2010 Total Transaction 2011 2012 Year Collection Efficiency No. of securities WCE Figure 3 Figure 2 100% 98% 96% 94% 92% 90% 88%

- 11. Preliminary Analysis of CV Pools – AU only

- 12. Data & Methodology Used Data Used: Securitized CV pool details from the Pool Performance reports (Sep’12) of Rating Agencies (CARE, ICRA and CRISIL) Total number of Transactions (Data Points) - 21 Period of Transactions - 2010-2012 Parameters Collected for Analysis: Transaction Details : Transaction month, Transaction Name, Originator, Transaction Structure, Type of Transaction, Rating Assigned for Seniors and Junior Initial Pool Details : Pool Principal, Pool Composition, Credit Enhancement (% of Initial POS), EIS (% of Initial POS), Weighted Average Seasoning (Months), Tenure (Years) Pool Performance Details : Cumulative Collection Efficiency (CCE) Methodology Used: Collection of data from the Pool Performance reports of Rating Agencies & Identification of factors, which are to be used for the analysis of transactions Single & Multiple Regression of these factors with CCE, Scatter plots for trend capture Observe the significance level of factors affecting the delinquencies

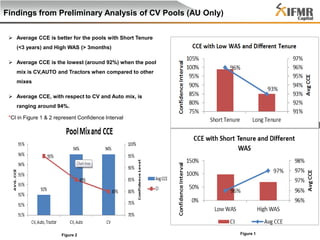

- 13. Findings from Preliminary Analysis of CV Pools (AU Only) Average CCE is better for the pools with Short Tenure (<3 years) and High WAS (> 3months) Average CCE is the lowest (around 92%) when the pool mix is CV,AUTO and Tractors when compared to other mixes Average CCE, with respect to CV and Auto mix, is ranging around 94%. *CI in Figure 1 & 2 represent Confidence Interval Figure 2 Figure 1

- 14. Detailed Analysis of CV Pools – All Originators

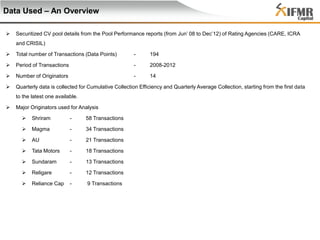

- 15. Data Used – An Overview Securitized CV pool details from the Pool Performance reports (from Jun’ 08 to Dec’12) of Rating Agencies (CARE, ICRA and CRISIL) Total number of Transactions (Data Points) - 194 Period of Transactions - 2008-2012 Number of Originators - 14 Quarterly data is collected for Cumulative Collection Efficiency and Quarterly Average Collection, starting from the first data to the latest one available. Major Originators used for Analysis Shriram - 58 Transactions Magma - 34 Transactions AU - 21 Transactions Tata Motors - 18 Transactions Sundaram - 13 Transactions Religare - 12 Transactions Reliance Cap - 9 Transactions

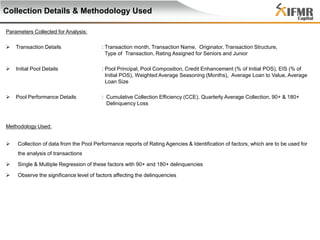

- 16. Collection Details & Methodology Used Parameters Collected for Analysis: Transaction Details : Transaction month, Transaction Name, Originator, Transaction Structure, Type of Transaction, Rating Assigned for Seniors and Junior Initial Pool Details : Pool Principal, Pool Composition, Credit Enhancement (% of Initial POS), EIS (% of Initial POS), Weighted Average Seasoning (Months), Average Loan to Value, Average Loan Size Pool Performance Details : Cumulative Collection Efficiency (CCE), Quarterly Average Collection, 90+ & 180+ Delinquency Loss Methodology Used: Collection of data from the Pool Performance reports of Rating Agencies & Identification of factors, which are to be used for the analysis of transactions Single & Multiple Regression of these factors with 90+ and 180+ delinquencies Observe the significance level of factors affecting the delinquencies

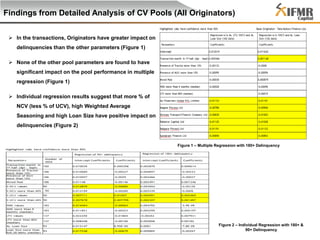

- 17. Findings from Detailed Analysis of CV Pools (All Originators) In the transactions, Originators have greater impact on delinquencies than the other parameters (Figure 1) None of the other pool parameters are found to have significant impact on the pool performance in multiple regression (Figure 1) Individual regression results suggest that more % of NCV (less % of UCV), high Weighted Average Seasoning and high Loan Size have positive impact on delinquencies (Figure 2) Figure 1 – Multiple Regression with 180+ Delinquency Figure 2 – Individual Regression with 180+ & 90+ Delinquency

- 18. Limitations & Future Works Limitations Data Collected for only those transactions that are done after June 2008. Reporting format was not uniform across all the rating agencies. Inferences are based on small sample size. Future Works Time Series analysis of Delinquencies and Cumulative Collection Efficiency of earlier transactions to date and also from the perspective of an originators can be done All the originators should be analysed according to the individual assets of the pools (type of underlying vehicles). Analysis of relation between the closely related independent factors viz. Loan size and % of NCV so as to figure out that which of the two factors actually impacts the performance Comparing the rating rationales, for similar rated transaction with different credit enhancement or vice versa, more deeply to understand the factors seen by rating agencies

- 19. Market Outlook

- 20. Recent Study by ICRA Asset Quality of CV 90+ DPD 6.8% and 180+ DPD 3.8% UCV – NCV - 90+ DPD 6.2% and 180+ DPD 1.5% Macro-Economic Indicators Correlation between GDP vs. 90+ DPD = -83% (-91% with three months lag of 90+dpd) Correlation between IIP vs. 90+ DPD = -91% Portfolio Analysis TN & Maharashtra contributed around 35% of total disbursement MHCV weaker performance than other asset classes High Tenure Contract (3 Years) showed weaker performance Contracts originated in Orissa and Goa is affected a lot because of Mining Issues In FY13, Average Tenure is 43 months Contracts with higher interest rates performed weakly Repossession Loss 37% in New LCV and 39% in New MHCV Loss due to repossession in UCV is slightly lower than New CV’s (Probably because of Lower LTV) Repossession Rates in FY13 is ranging around 30-50% Resale Value is reduced by 10-20% due to demand decline and discount on new vehicles

- 21. Conclusion

- 22. Concluding Remarks Originators play an important role compared to other parameters when it comes to the performance of CV Pools. Also, with fair degree of confidence, it can be said following parameters have an impact in a pool’s performance % of NCV Exposure Weighted Average Seasoning Tenure of the pool Loan Size (May be correlated with other factors like % of NCV) GDP and IIP are the major indicators of CV industry LCV - Safer bet than MCVs and HCVs

- 23. Questions ??