Indusind presentation

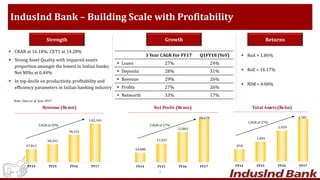

- 2. IndusInd Bank – Building Scale with Profitability Strength Growth Returns CRAR at 16.18%; CET1 at 14.28% Strong Asset Quality with impaired assets proportion amongst the lowest in Indian banks; Net NPAs at 0.44% In top decile on productivity, profitability and efficiency parameters in Indian banking industry 3 Year CAGR For FY17 Q1FY18 (YoY) Loans 27% 24% Deposits 28% 31% Revenue 29% 26% Profits 27% 26% Networth 33% 17% RoA = 1.86% RoE = 16.17% NIM = 4.00% Note: Data as of June 2017 2 Revenue(Rsmn) Net Profit (Rsmn) Total Assets(Rsbn) 47,812 58,241 78,135 1,02,341 FY14 FY15 FY16 FY17 14,080 17,937 22,865 28,679 FY14 FY15 FY16 FY17 870 1,091 1,429 1,787 FY14 FY15 FY16 FY17 CAGR of 29% CAGR of 27% CAGR of 27%

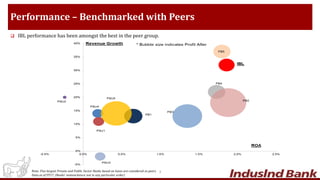

- 3. Performance – Benchmarked with Peers IBL performance has been amongst the best in the peer group. Note: Five largest Private and Public Sector Banks based on loans are considered as peers. Data as of FY17. (Banks’ nomenclature not in any particular order) 3

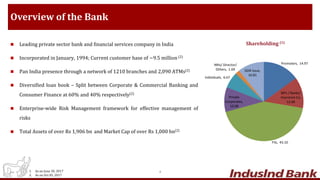

- 4. Overview of the Bank Leading private sector bank and financial services company in India Incorporated in January, 1994; Current customer base of ~9.5 million (2) Pan India presence through a network of 1210 branches and 2,090 ATMs(2) Diversified loan book – Split between Corporate & Commercial Banking and Consumer Finance at 60% and 40% respectively(2) Enterprise-wide Risk Management framework for effective management of risks Total Assets of over Rs 1,906 bn and Market Cap of over Rs 1,000 bn(2) Shareholding (1) 1. As on June 30, 2017 2. As on Oct 05, 2017 4 Promoters, 14.97 MFs / Banks/ Insurance Co, 12.68 FIIs, 43.10 Private Corporates, 10.08 Individuals, 6.67 NRIs/ Director/ Others, 1.69 GDR issue, 10.81

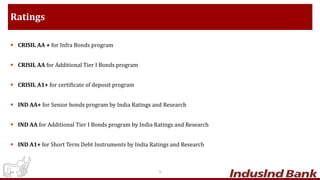

- 5. Ratings CRISIL AA + for Infra Bonds program CRISIL AA for Additional Tier I Bonds program CRISIL A1+ for certificate of deposit program IND AA+ for Senior bonds program by India Ratings and Research IND AA for Additional Tier I Bonds program by India Ratings and Research IND A1+ for Short Term Debt Instruments by India Ratings and Research 5

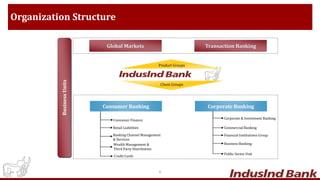

- 6. Organization Structure Product Groups Client Groups Consumer Banking Corporate Banking Consumer Finance Retail Liabilities Corporate & Investment Banking Commercial Banking Business Banking Public Sector Unit Banking Channel Management & Services Wealth Management & Third Party Distribution Global Markets Transaction Banking BusinessUnits Financial Institutions Group Credit Cards 6

- 7. Investment Highlights Universal Banking Offerings Growing Liability and Fee Franchise Focused Execution on Risk, Operations and Portfolio Well Defined Expansion Strategy History of Technology Refresh and Innovation Stable Asset Quality Experienced Management Team 1 2 3 4 5 6 7 7

- 8. Planning Cycle 4 Strategy Well Defined Expansion Strategy1 Market Share with Profitability Do More of the Same Strategy Digitize to Differentiate, Diversify and Create Domain Leadership BroadThemes Financing Livelihoods Finding Customers from Within Reengineering Our Businesses Sustainable Banking 8

- 9. Strategic Themes Well Defined Expansion Strategy1 Internal Collaboration and Cross Sell Enriching Client Experience Digitization of Businesses Focus on Productivity Sustainability Rebalancing of Loan Book Rural Banking and Microfinance 9

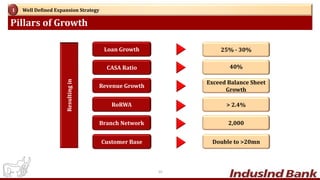

- 10. Pillars of Growth Well Defined Expansion Strategy1 CASA Ratio Revenue Growth RoRWA Branch Network Loan Growth 40% Exceed Balance Sheet Growth > 2.4% 2,000 25% - 30% Resultingin Customer Base Double to >20mn 10

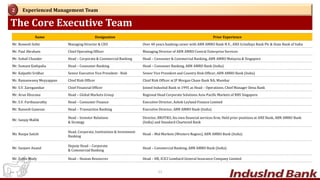

- 11. The Core Executive Team Experienced Management Team2 Name Designation Prior Experience Mr. Romesh Sobti Managing Director & CEO Over 40 years banking career with ABN AMRO Bank N.V., ANZ Grindlays Bank Plc & State Bank of India Mr. Paul Abraham Chief Operating Officer Managing Director of ABN AMRO Central Enterprise Services Mr. Suhail Chander Head – Corporate & Commercial Banking Head – Consumer & Commercial Banking, ABN AMRO Malaysia & Singapore Mr. Sumant Kathpalia Head – Consumer Banking Head – Consumer Banking, ABN AMRO Bank (India) Mr. Kalpathi Sridhar Senior Executive Vice President - Risk Senior Vice President and Country Risk Officer, ABN AMRO Bank (India) Mr. Ramaswamy Meyyappan Chief Risk Officer Chief Risk Officer at JP Morgan Chase Bank NA, Mumbai Mr. S.V. Zaregaonkar Chief Financial Officer Joined IndusInd Bank in 1995 as Head – Operations; Chief Manager Dena Bank Mr. Arun Khurana Head – Global Markets Group Regional Head Corporate Solutions Asia-Pacific Markets of RBS Singapore Mr. S.V. Parthasarathy Head – Consumer Finance Executive Director, Ashok Leyland Finance Limited Mr. Ramesh Ganesan Head – Transaction Banking Executive Director, ABN AMRO Bank (India) Mr. Sanjay Mallik Head – Investor Relations & Strategy Director, BROTKO, his own financial services firm; Held prior positions at ANZ Bank, ABN AMRO Bank (India) and Standard Chartered Bank Ms. Roopa Satish Head, Corporate, Institutions & Investment Banking Head – Mid Markets (Western Region), ABN AMRO Bank (India) Mr. Sanjeev Anand Deputy Head – Corporate & Commercial Banking Head – Commercial Banking, ABN AMRO Bank (India) Mr. Zubin Mody Head – Human Resources Head – HR, ICICI Lombard General Insurance Company Limited 11

- 12. Performance Across Key Financial Vectors Experienced Management Team2 QIP & Pref. Allot. Rs 5,081 crs 3.71 3.99 2014 Current NIMs (%) 1.81 1.86 2014 2017 RoA (%) 17.48 15.26 2014 2017 RoE (%) 47.1 46.7 2014 2017 Cost / Income (%) 12 0.33 0.39 2014 2017 Net NPAs (%) 3.0 4.0 2014 2017 Revenue per Employee (Rs mn)

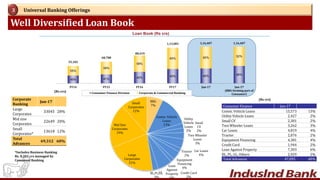

- 13. Well Diversified Loan Book Universal Banking Offerings3 Loan Book (Rs crs) (Rs crs) (Rs crs) 13 45% 41% 42% 40% 40% 48% 55% 59% 58% 60% 60% 52% 55,102 68,788 88,419 1,13,081 1,16,407 1,16,407 FY14 FY15 FY16 FY17 Jun-17 Jun-17 (BBG forming part of Consumer)Consumer Finance Division Corporate & Commercial Banking BBG 7% Comm. Vehicle Loans 13% Utility Vehicle Loans 2% Small CV 2% Two Wheeler Loans 3% Car Loans 4% Tractor 2% Equipment Financing 4% Credit Card 2% Loan Against Property 6% BL,PL,GL 3% Large Corporates 21% Mid Size Corporates 19% Small Corporates 12% Consumer Finance Jun-17 Comm. Vehicle Loans 15,573 13% Utility Vehicle Loans 2,427 2% Small CV 2,381 2% Two Wheeler Loans 3,262 3% Car Loans 4,819 4% Tractor 2,076 2% Equipment Financing 4,381 4% Credit Card 1,944 2% Loan Against Property 7,303 6% BL, PL, GL, Others 2,929 2% Total Advances 47,095 40% *Includes Business Banking Rs. 8,202 crs managed by Consumer Banking Corporate Banking Jun-17 Large Corporates 33045 28% Mid size Corporates 22649 20% Small Corporates* 13618 12% Total Advances 69,312 60%

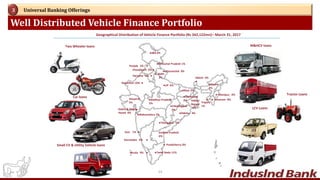

- 14. Well Distributed Vehicle Finance Portfolio Universal Banking Offerings3 14 Andhra Pradesh 6% ●Assam 2% ●Bihar 2% Chandigarh 0% ● ●Chhatisgarh 3%Dadra & Nagar Haveli 0% ● Delhi 2% Goa 1% ● ●Gujarat 5% Haryana 5% ● ●Himachal Pradesh 1% ●J&K 0% ●Jharkhand 3% Karnataka 4% ● Kerala 9% ● ●Madhya Pradesh 5% ●Maharashtra 7% ● Mizoram 0% ●Odisha 4% ● Pondicherry 0% Punjab 3% ● Rajasthan 10% ● ●Uttaranchal 0% ●West Bengal 5% Sikkim 0% ● ●Tamil Nadu 11% Tripura 1% ●UP 6% ● ● Geographical Distribution of Vehicle Finance Portfolio (Rs 342,122mn)– March 31, 2017 Two Wheeler loans Car loans M&HCV loans Small CV & Utility Vehicle loans LCV Loans ●Telangana 5% ● Manipur, 0% Tractor Loans

- 15. Comprehensive Corporate and Commercial Banking Offering Universal Banking Offerings3 15 Distribution of Corporate & Commercial Banking Network Product and Service Offerings Working Capital Finance Short Term Finance Bill Discounting Export Credit Term Lending Buyer’s Credit / Supplier’s Credit Asset based financing Lease Rental Discounting Supply Chain Finance Warehouse Receipt Finance Agri Finance Inclusive Banking Non Fund Based Services Value Added Services Letter of Credit Bank Guarantees Forward Contracts / Derivatives Channel Financing / Associate Financing Cash Management Services Corporate Salary Accounts Liability/ Investment Products Commodity Finance Project Finance Forex / Derivative Desks Fund Based Services Andhra Pradesh Assam Bihar Punjab Chandigarh Chhatisgarh Gujarat Haryana Jharkhand Karnataka Kerala Madhya Pradesh Maharashtra Orissa Rajasthan West Bengal Tamil Nadu UP ● Corporate & Institutions Banking Public Sector Units Business Banking Group Commercial Banking Goa Tripura Nagaland Meghalaya Pondicherry Uttarakhand HP NonFund BasedServices Structured Finance Debt Syndication Advisory Services Investment Banking Telengana

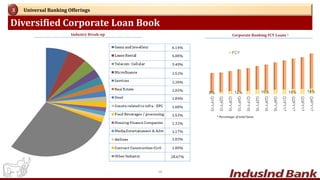

- 16. Diversified Corporate Loan Book Universal Banking Offerings3 16 8% 12% 16% 14% 14% Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 FCY Corporate Banking FCY Loans *Industry Break-up * Percentage of total loans

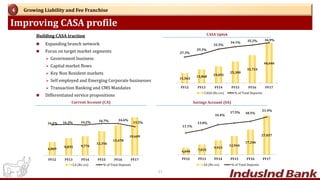

- 17. Improving CASA profile Growing Liability and Fee Franchise4 CASA Uptick Savings Account (SA)Current Account (CA) 11,563 15,868 19,691 25,300 32,724 46,646 27.3% 29.3% 32.5% 34.1% 35.2% 36.9% 10% 16% 21% 27% 33% 38% 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 FY12 FY13 FY14 FY15 FY16 FY17 CASA (Rs crs) % of Total Deposits 6,869 8,835 9,776 12,356 15,478 19,609 16.2% 16.3% 16.2% 16.7% 16.6% 15.5% 5% 7% 9% 11% 13% 15% 17% 19% 0 3,000 6,000 9,000 12,000 15,000 18,000 21,000 FY12 FY13 FY14 FY15 FY16 FY17 CA (Rs crs) % of Total Deposits Building CASA traction Expanding branch network Focus on target market segments Government business Capital market flows Key Non Resident markets Self employed and Emerging Corporate businesses Transaction Banking and CMS Mandates Differentiated service propositions 4,694 7,033 9,915 12,944 17,246 27,037 11.1% 13.0% 16.4% 17.5% 18.5% 21.4% -3.0% 1.0% 5.0% 9.0% 13.0% 17.0% 21.0% 25.0% 0 5,000 10,000 15,000 20,000 25,000 30,000 FY12 FY13 FY14 FY15 FY16 FY17 SA (Rs crs) % of Total Deposits 17

- 18. Efficient Distribution and Cross Sell Growing Liability and Fee Franchise4 Life Insurance General Insurance Health Insurance Mortgage and Broking 18

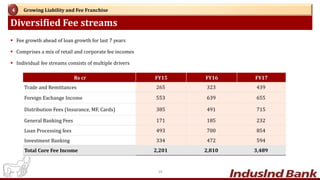

- 19. Diversified Fee streams Growing Liability and Fee Franchise4 Fee growth ahead of loan growth for last 7 years Comprises a mix of retail and corporate fee incomes Individual fee streams consists of multiple drivers Rs cr FY15 FY16 FY17 Trade and Remittances 265 323 439 Foreign Exchange Income 553 639 655 Distribution Fees (Insurance, MF, Cards) 385 491 715 General Banking Fees 171 185 232 Loan Processing fees 493 700 854 Investment Banking 334 472 594 Total Core Fee Income 2,201 2,810 3,489 19

- 20. Asset Quality Managed Across Cycles Stable Asset Quality5 1.23% 1.01% 0.98% 1.03% 1.12% 0.81% 0.87% 0.93% FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 0.50% 0.28% 0.27% 0.31% 0.33% 0.31% 0.36% 0.39% FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 Gross NPA Credit Cost * 0.79% 0.61% 0.41% 0.46% 0.41% 0.48% 0.53% 0.59% FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 Net NPA * Net of recoveries 20

- 21. Well Rated Corporate Portfolio Stable Asset Quality5 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% IB1 (AAA) IB2+ (AA+) IB2 (AA) IB2- (AA-) IB3+ (A+) IB3 (A) IB3- (A- ) IB4+ (BBB+) IB4 (BBB) IB4- (BBB-) IB5+ (BB+) IB5 (BB) IB5- (BB-) IB6 (B) IB7 (C ) IB8 (C ) NPA (D) Unsecured Non Fund Based % Secured Non Fund Based % Unsecured Fund Based % Secured Fund Based % P E R C E N T O F R A T E D P O R T F O L I O Investment Grade Sub Investment Grade 21 As of June 2017

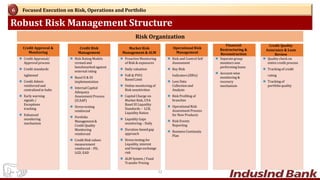

- 22. Robust Risk Management Structure Focused Execution on Risk, Operations and Portfolio6 Risk and Control Self Assessment Key Risk Indicators(KRIs) Loss Data Collection and Analysis Risk Profiling of branches Operational Risk Assessment Process for New Products Risk Events Reporting Business Continuity Plan Separate group monitors non performing loans Account-wise monitoring & recovery mechanism Quality check on entire credit process Tracking of credit rating Tracking of portfolio quality Proactive Monitoring of Risk & exposures Daily valuation VaR & PV01 Based Limit Online monitoring of Risk sensitivities Capital Charge on Market Risk, CVA Basel III Liquidity Standards – LCR, Liquidity Ratios Liquidity Gaps monitoring – Daily Duration-based gap approach Stress testing for Liquidity, interest and foreign exchange risk ALM System / Fund Transfer Pricing Risk Rating Models revised and benchmarked against external rating Basel II & III implementation Internal Capital Adequacy Assessment Process (ICAAP) Stress testing reinforced Portfolio Management & Credit Quality Monitoring reinforced Credit Risk values measurement reinforced – PD, LGD, EAD Credit Appraisal/ Approval process Credit standards tightened Credit Admin reinforcedand centralised in hubs Early warning signals / Exceptions tracking Enhanced monitoring mechanism 22 Credit Approval & Monitoring Credit Risk Management Market Risk Management & ALM Operational Risk Management Financial Restructuring & Reconstruction Credit Quality Assurance & Loan Review Risk Organization

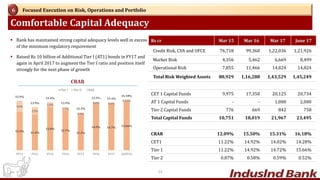

- 23. Comfortable Capital Adequacy Focused Execution on Risk, Operations and Portfolio6 Rs cr Mar 15 Mar 16 Mar 17 June 17 Credit Risk, CVA and UFCE 76,718 99,360 1,22,036 1,21,926 Market Risk 4,356 5,462 6,669 8,499 Operational Risk 7,855 11,466 14,824 14,824 Total Risk Weighted Assets 88,929 1,16,288 1,43,529 1,45,249 CET 1 Capital Funds 9,975 17,350 20,125 20,734 AT 1 Capital Funds - - 1,000 2,000 Tier 2 Capital Funds 776 669 842 758 Total Capital Funds 10,751 18,019 21,967 23,495 CRAR 12.09% 15.50% 15.31% 16.18% CET1 11.22% 14.92% 14.02% 14.28% Tier 1 11.22% 14.92% 14.72% 15.66% Tier 2 0.87% 0.58% 0.59% 0.52% Bank has maintained strong capital adequacy levels well in excess of the minimum regulatory requirement Raised Rs 10 billion of Additional Tier I (AT1) bonds in FY17 and again in April 2017 to augment the Tier I ratio and position itself strongly for the next phase of growth CRAR 23 12.3% 11.4% 13.8% 12.7% 11.2% 14.9% 14.7% 15.66% 3.6% 2.5% 1.6% 1.1% 0.9% 0.6% 0.6% 0.52% 15.9% 13.9% 15.4% 13.9% 12.1% 15.5% 15.3% 16.18% FY11 FY12 FY13 FY14 FY15 FY16 FY17 Q1FY18 Tier I Tier II CRAR

- 24. Diversified Funding Sources Focused Execution on Risk, Operations and Portfolio6 Funding Mix* 24 Net Worth 12% CA Deposits; 11% SA Deposits; 15% Retail & SME TD; 19% Public Sector Units TD; 9% Financial Institutions TD; 10% Corporate TD; 4% Capital Markets TD; 2% Refinance; 8% Infra Bonds; 1% AT1 Bonds; 1% Other Borrowings; 3% Other Liabilities; 5% * Data as on March 2017 78% 76% 82% 83% 70 72 74 76 78 80 82 84 86 - 2,00,000 4,00,000 6,00,000 8,00,000 10,00,000 12,00,000 14,00,000 16,00,000 18,00,000 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Borrowings Deposits Deposits & Borrowings Evolution

- 25. 9.5% 9.7% 9.3% 9.2% 9.2% 9.1% 9.3% 9.4% Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 9,558 28,215 14,683 29,823 65.1% 74.2% 66.4% 70.7% 78.4% 81.1% 91.3% 94.6% 91.6% Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 HQLA (Rs cr) Net Cash Outflow (Rs cr) LCR (%) Stable Liquidity and Leverage Profile Focused Execution on Risk, Operations and Portfolio6 Liquidity Coverage Ratio 25 Basel III Leverage Ratio Required >4.5% Required >80%

- 26. Distribution Expansion to Drive Growth Focused Execution on Risk, Operations and Portfolio6 Note: Numbers given above are total branches in each state. This does not include Branch/Representative Office in London, Dubai and Abu Dhabi. 602 1,210 2014 Current Branches 4.5 9.5 2014 Current Clients (mn) 26

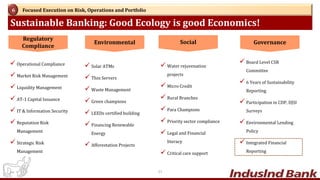

- 27. Sustainable Banking: Good Ecology is good Economics! Focused Execution on Risk, Operations and Portfolio6 27 Regulatory Compliance Operational Compliance Market Risk Management Liquidity Management AT-1 Capital Issuance IT & Information Security Reputation Risk Management Strategic Risk Management Environmental Solar ATMs Thin Servers Waste Management Green champions LEEDs certified building Financing Renewable Energy Afforestation Projects Social Water rejuvenation projects Micro Credit Rural Branches Para Champions Priority sector compliance Legal and Financial literacy Critical care support Governance Board Level CSR Committee 6 Years of Sustainability Reporting Participation in CDP, DJSI Surveys Environmental Lending Policy Integrated Financial Reporting A

- 28. Innovation as a Service Differentiator History of Technology Refresh and Innovation7 Channel Innovation Service Innovation Product Innovation Client Experience Edge 28

- 29. Digitize to Differentiate, Diversify and Create Domain Expertise History of Technology Refresh and Innovation7 29 Integrated Digital Strategy to extract significant value (14% of 2020 profit) via: 1. Agility & Innovation as Service Differentiator 2. Operating Efficiency in Front & Back Office 3. Evolution to Online/Digital Channels 4. Partnering with the Digital Ecosystems 5. Improved Decision Making & Analytics 6. Transform to Digital Offerings 7. Re-skilling Staff on Digital Technologies

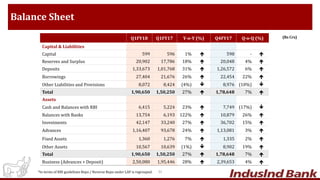

- 31. Balance Sheet (Rs Crs) 31*In terms of RBI guidelines Repo / Reverse Repo under LAF is regrouped. * Q1FY18 Q1FY17 Y-o-Y (%) Q4FY17 Q-o-Q (%) Capital & Liabilities Capital 599 596 1% 598 - Reserves and Surplus 20,902 17,786 18% 20,048 4% Deposits 1,33,673 1,01,768 31% 1,26,572 6% Borrowings 27,404 21,676 26% 22,454 22% Other Liabilities and Provisions 8,072 8,424 (4%) 8,976 (10%) Total 1,90,650 1,50,250 27% 1,78,648 7% Assets Cash and Balances with RBI 6,415 5,224 23% 7,749 (17%) Balances with Banks 13,754 6,193 122% 10,879 26% Investments 42,147 33,240 27% 36,702 15% Advances 1,16,407 93,678 24% 1,13,081 3% Fixed Assets 1,360 1,276 7% 1,335 2% Other Assets 10,567 10,639 (1%) 8,902 19% Total 1,90,650 1,50,250 27% 1,78,648 7% Business (Advances + Deposit) 2,50,080 1,95,446 28% 2,39,653 4%

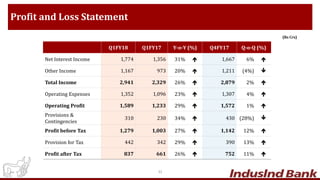

- 32. Profit and Loss Statement (Rs Crs) 32 Q1FY18 Q1FY17 Y-o-Y (%) Q4FY17 Q-o-Q (%) Net Interest Income 1,774 1,356 31% 1,667 6% Other Income 1,167 973 20% 1,211 (4%) Total Income 2,941 2,329 26% 2,879 2% Operating Expenses 1,352 1,096 23% 1,307 4% Operating Profit 1,589 1,233 29% 1,572 1% Provisions & Contingencies 310 230 34% 430 (28%) Profit before Tax 1,279 1,003 27% 1,142 12% Provision for Tax 442 342 29% 390 13% Profit after Tax 837 661 26% 752 11%

- 33. Accolades 33

- 34. Award Winning Brand / Franchise 34 Business Today 2016 “The Best CEO (BFSI)” Mr. Romesh Sobti Forbes India 2016 Forbes’ Super 50 Companies in India BrandZ Top 50 WPP Plc & Milward Brown 2016 Ranked 12th Most Valuable Indian Brands Celent Model Bank 2017 Winner- Fraud Management and Cybersecurity

- 35. Thank You

- 36. Disclaimer This presentation has been prepared by IndusInd Bank Limited (the “Bank”) solely for information purposes, without regard to any specific objectives, financial situations or informational needs of any particular person. All information contained has been prepared solely by the Bank. No information contained herein has been independently verified by anyone else. This presentation may not be copied, distributed, redistributed or disseminated, directly or indirectly, in any manner. This presentation does not constitute an offer or invitation, directly or indirectly, to purchase or subscribe for any securities of the Bank by any person in any jurisdiction, including India and the United States. No part of it should form the basis of or be relied upon in connection with any investment decision or any contract or commitment to purchase or subscribe for any securities. Any person placing reliance on the information contained in this presentation or any other communication by the Bank does so at his or her own risk and the Bank shall not be liable for any loss or damage caused pursuant to any act or omission based on or in reliance upon the information contained herein. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Such information and opinions are in all events not current after the date of this presentation. Further, past performance is not necessarily indicative of future results. This presentation is not a complete description of the Bank. This presentation may contain statements that constitute forward-looking statements. All forward looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those contemplated by the relevant forward-looking statement. Important factors that could cause actual results to differ materially include, among others, future changes or developments in the Bank’s business, its competitive environment and political, economic, legal and social conditions. Given these risks, uncertainties and other factors, viewers of this presentation are cautioned not to place undue reliance on these forward-looking statements. The Bank disclaims any obligation to update these forward-looking statements to reflect future events or developments. Except as otherwise noted, all of the information contained herein is indicative and is based on management information, current plans and estimates in the form as it has been disclosed in this presentation. Any opinion, estimate or projection herein constitutes a judgment as of the date of this presentation and there can be no assurance that future results or events will be consistent with any such opinion, estimate or projection. The Bank may alter, modify or otherwise change in any manner the content of this presentation, without obligation to notify any person of such change or changes. The accuracy of this presentation is not guaranteed, it may be incomplete or condensed and it may not contain all material information concerning the Bank. This presentation is not intended to be an offer document or a prospectus under the Companies Act, 2013 and Rules made thereafter , as amended, the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009, as amended or any other applicable law. Figures for the previous period / year have been regrouped wherever necessary to conform to the current period’s / year’s presentation. Total in some columns / rows may not agree due to rounding off. Note: All financial numbers in the presentation are from Audited Financials or Limited Reviewed financials or based on Management estimates. 36