Perspective On Saa S Financials (Published)

- 1. Perspective on SaaS Financials February 25 th 2009, Palo Alto Hills Proprietary and Confidential Bessemer CEO Summit on SaaS David Cowan Philippe Botteri

- 2. Objectives of today’s discussion Present Bessemer perspective on key SaaS financial metrics Assess how these metrics impact cash consumption Understand the profitability of the SaaS business model at scale and how it compares to Enterprise Software

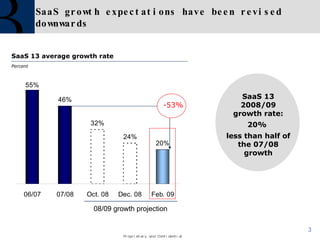

- 3. SaaS growth expectations have been revised downwards SaaS 13 average growth rate Percent 08/09 growth projection SaaS 13 2008/09 growth rate: 20% less than half of the 07/08 growth -53%

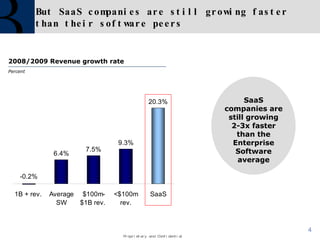

- 4. But SaaS companies are still growing faster than their software peers 2008/2009 Revenue growth rate Percent SaaS companies are still growing 2-3x faster than the Enterprise Software average

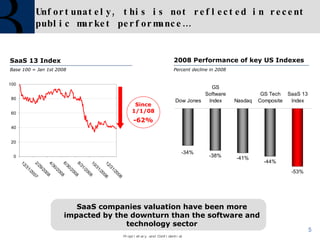

- 5. Unfortunately, this is not reflected in recent public market performance… SaaS 13 Index SaaS companies valuation have been more impacted by the downturn than the software and technology sector Base 100 = Jan 1st 2008 Since 1/1/08 -62% 2008 Performance of key US Indexes Percent decline in 2008

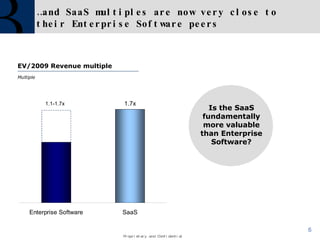

- 6. … and SaaS multiples are now very close to their Enterprise Software peers EV/2009 Revenue multiple Multiple 1.1-1.7x Is the SaaS fundamentally more valuable than Enterprise Software?

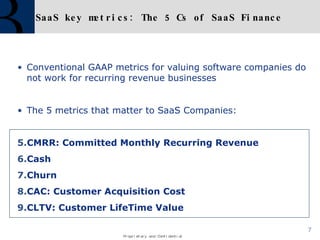

- 7. SaaS key metrics: The 5 Cs of SaaS Finance Conventional GAAP metrics for valuing software companies do not work for recurring revenue businesses The 5 metrics that matter to SaaS Companies: CMRR: Committed Monthly Recurring Revenue Cash Churn CAC: Customer Acquisition Cost CLTV: Customer LifeTime Value

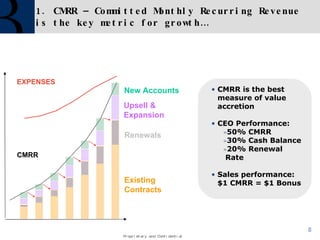

- 8. 1. CMRR – Committed Monthly Recurring Revenue is the key metric for growth… … to CMRR and transparency! CMRR Existing Contracts Renewals EXPENSES Cash burn rate CMRR New Accounts Upsell & Expansion Existing Contracts Renewals EXPENSES CMRR is the best measure of value accretion CEO Performance: 50% CMRR 30% Cash Balance 20% Renewal Rate Sales performance: $1 CMRR = $1 Bonus

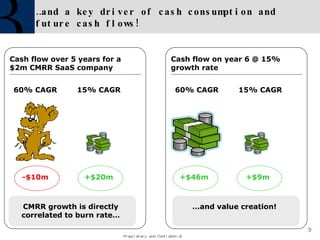

- 9. …and a key driver of cash consumption and future cash flows! CMRR growth is directly correlated to burn rate… Cash flow over 5 years for a $2m CMRR SaaS company 60% CAGR 15% CAGR -$10m +$20m Cash flow on year 6 @ 15% growth rate 60% CAGR 15% CAGR +$9m +$46m … and value creation!

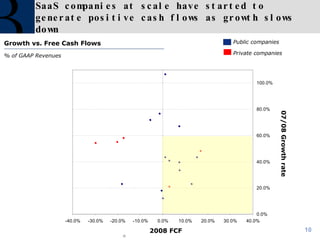

- 10. SaaS companies at scale have started to generate positive cash flows as growth slows down Growth vs. Free Cash Flows % of GAAP Revenues Private companies Public companies 07/08 Growth rate 2008 FCF

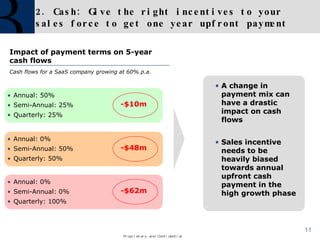

- 11. 2. Cash: Give the right incentives to your sales force to get one year upfront payment Impact of payment terms on 5-year cash flows Cash flows for a SaaS company growing at 60% p.a. A change in payment mix can have a drastic impact on cash flows Sales incentive needs to be heavily biased towards annual upfront cash payment in the high growth phase Annual: 50% Semi-Annual: 25% Quarterly: 25% -$10m Annual: 0% Semi-Annual: 50% Quarterly: 50% -$48m Annual: 0% Semi-Annual: 0% Quarterly: 100% -$62m

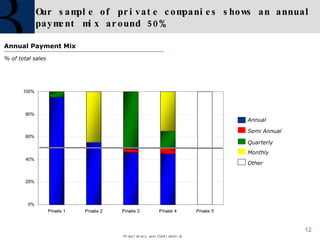

- 12. Our sample of private companies shows an annual payment mix around 50% Annual Payment Mix % of total sales Semi Annual Annual Quarterly Monthly Other

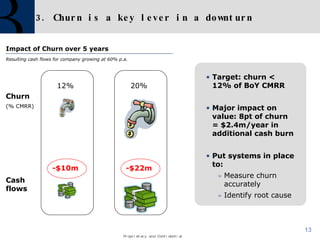

- 13. 3. Churn is a key lever in a downturn Impact of Churn over 5 years Resulting cash flows for company growing at 60% p.a. Target: churn < 12% of BoY CMRR Major impact on value: 8pt of churn = $2.4m/year in additional cash burn Put systems in place to: Measure churn accurately Identify root cause Churn (% CMRR) 12% 20% Cash flows -$10m -$22m

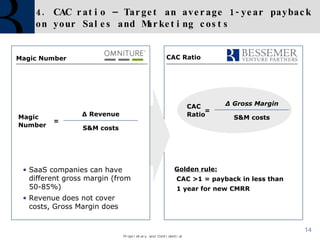

- 14. 4. CAC ratio – Target an average 1-year payback on your Sales and Marketing costs CAC Ratio Magic Number Magic Number = Δ Revenue S&M costs CAC Ratio = Δ Gross Margin S&M costs Golden rule: CAC >1 = payback in less than 1 year for new CMRR SaaS companies can have different gross margin (from 50-85%) Revenue does not cover costs, Gross Margin does

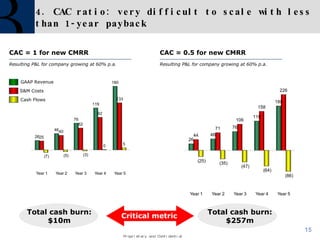

- 15. 4. CAC ratio: very difficult to scale with less than 1-year payback CAC = 1 for new CMRR Resulting P&L for company growing at 60% p.a. CAC = 0.5 for new CMRR Resulting P&L for company growing at 60% p.a. GAAP Revenue S&M Costs Cash Flows Total cash burn: $10m Total cash burn: $257m Critical metric

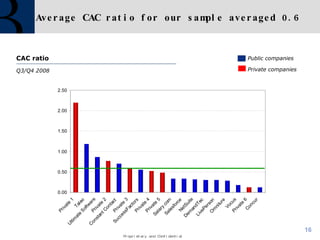

- 16. Average CAC ratio for our sample averaged 0.6 CAC ratio Q3/Q4 2008 Private companies Public companies

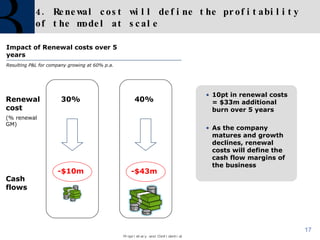

- 17. 4. Renewal cost will define the profitability of the model at scale 10pt in renewal costs = $33m additional burn over 5 years As the company matures and growth declines, renewal costs will define the cash flow margins of the business Impact of Renewal costs over 5 years Resulting P&L for company growing at 60% p.a. Renewal cost (% renewal GM) 30% 40% Cash flows -$10m -$43m

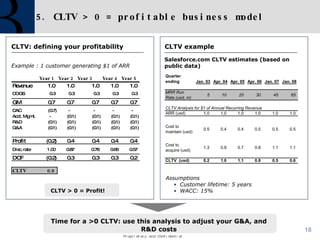

- 18. 5. CLTV > 0 = profitable business model CLTV: defining your profitability CLTV > 0 = Profit! Example : 1 customer generating $1 of ARR Time for a >0 CLTV: use this analysis to adjust your G&A, and R&D costs Assumptions Customer lifetime: 5 years WACC: 15% CLTV example Salesforce.com CLTV estimates (based on public data)

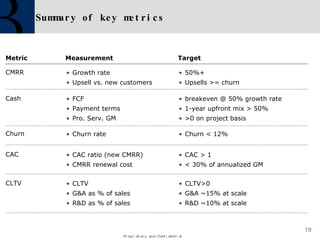

- 19. Summary of key metrics CMRR Metric Measurement Growth rate Upsell vs. new customers Target 50%+ Upsells >= churn Cash FCF Payment terms Pro. Serv. GM breakeven @ 50% growth rate 1-year upfront mix > 50% >0 on project basis Churn Churn rate Churn < 12% CAC CAC ratio (new CMRR) CMRR renewal cost CAC > 1 < 30% of annualized GM CLTV CLTV G&A as % of sales R&D as % of sales CLTV>0 G&A ~15% at scale R&D ~10% at scale

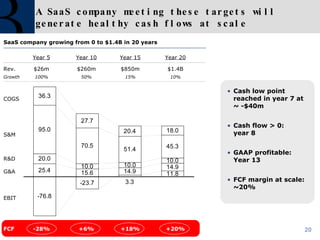

- 20. A SaaS company meeting these targets will generate healthy cash flows at scale SaaS company growing from 0 to $1.4B in 20 years Cash low point reached in year 7 at ~ -$40m Cash flow > 0: year 8 GAAP profitable: Year 13 FCF margin at scale: ~20% Year 5 Year 10 Year 15 Year 20 COGS S&M R&D G&A EBIT FCF -28% +6% +18% +20% Rev. $26m $260m $850m $1.4B Growth 100% 50% 15% 10%

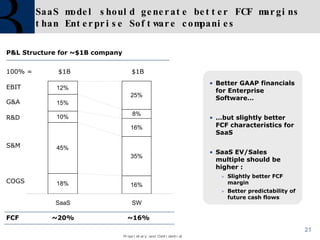

- 21. SaaS model should generate better FCF margins than Enterprise Software companies COGS S&M R&D G&A EBIT P&L Structure for ~$1B company 100% = $1B $1B FCF ~20% ~16% Better GAAP financials for Enterprise Software… … but slightly better FCF characteristics for SaaS SaaS EV/Sales multiple should be higher : Slightly better FCF margin Better predictability of future cash flows

- 22. Summary 5 C’s matter Small changes (positive and negative) can have massive impact on your cash consumption Sales productivity (CAC and renewal costs) is the most important lever that will define your cash burn: climbing the sales learning curve is critical before scaling Keep the faith: at scale, there is a pot of gold at the end of this rainbow!

- 23. Thank You! More on SaaS Finance at: www.bvp.com/saas www.cracking-the-code.blogspot.com