E-Way Bill under GST – Transport & Logistics.pptx

- 1. E-Way Bill By Ms. C. Keerthana Assistant Professor Department of B.Com. RM Sri Ramakrishna College of Arts and Science

- 2. Introduction to E-Way Bill • The E-Way Bill (Electronic Way Bill) is a document required for the movement of goods from one place to another under the Goods and Services Tax (GST) regime in India. It is generated electronically on the GST portal and serves as evidence of goods movement. Definition: • As per Rule 138 of CGST Rules, 2017, an e-way bill is a document that is required for the movement of goods worth more than Rs. 50,000 in value.

- 3. Objectives of E-Way Bill • To ensure seamless movement of goods across states. • To curb tax evasion and bring transparency. • To track goods in transit in real-time. • To replace physical forms and promote paperless compliance. • To improve logistics efficiency.

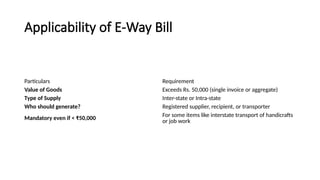

- 4. Applicability of E-Way Bill Particulars Requirement Value of Goods Exceeds Rs. 50,000 (single invoice or aggregate) Type of Supply Inter-state or Intra-state Who should generate? Registered supplier, recipient, or transporter Mandatory even if < ₹50,000 For some items like interstate transport of handicrafts or job work

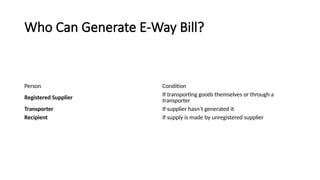

- 5. Who Can Generate E-Way Bill? Person Condition Registered Supplier If transporting goods themselves or through a transporter Transporter If supplier hasn’t generated it Recipient If supply is made by unregistered supplier

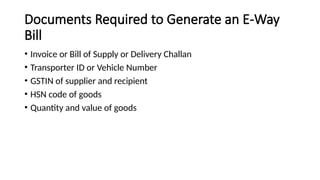

- 6. Documents Required to Generate an E-Way Bill • Invoice or Bill of Supply or Delivery Challan • Transporter ID or Vehicle Number • GSTIN of supplier and recipient • HSN code of goods • Quantity and value of goods

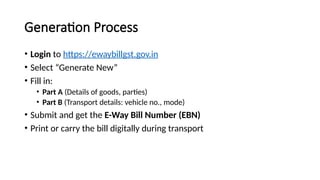

- 7. Generation Process • Login to https://ewaybillgst.gov.in • Select “Generate New” • Fill in: • Part A (Details of goods, parties) • Part B (Transport details: vehicle no., mode) • Submit and get the E-Way Bill Number (EBN) • Print or carry the bill digitally during transport

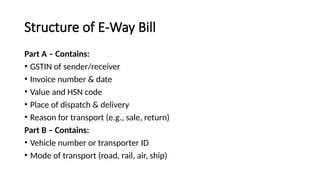

- 8. Structure of E-Way Bill Part A – Contains: • GSTIN of sender/receiver • Invoice number & date • Value and HSN code • Place of dispatch & delivery • Reason for transport (e.g., sale, return) Part B – Contains: • Vehicle number or transporter ID • Mode of transport (road, rail, air, ship)

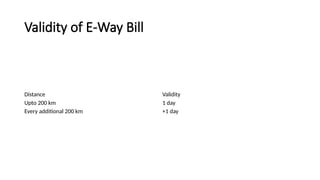

- 9. Validity of E-Way Bill Distance Validity Upto 200 km 1 day Every additional 200 km +1 day

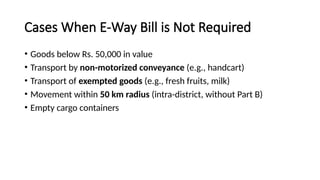

- 10. Cases When E-Way Bill is Not Required • Goods below Rs. 50,000 in value • Transport by non-motorized conveyance (e.g., handcart) • Transport of exempted goods (e.g., fresh fruits, milk) • Movement within 50 km radius (intra-district, without Part B) • Empty cargo containers

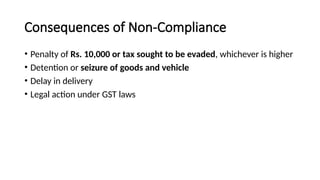

- 11. Consequences of Non-Compliance • Penalty of Rs. 10,000 or tax sought to be evaded, whichever is higher • Detention or seizure of goods and vehicle • Delay in delivery • Legal action under GST laws

- 12. Example Scenario • Example: • A seller in Chennai sends goods worth ₹75,000 to a buyer in Bangalore. • Seller must generate an e-way bill before dispatch. • Includes invoice, HSN, GSTIN, value, and transporter details. • E-Way bill number must accompany goods in transit.

- 13. Cancellation and Update • Can be cancelled within 24 hours if goods not transported. • Part B can be updated if the vehicle changes during transit. E-Way Bill by SMS or App • E-Way bills can also be generated through: • SMS facility • Mobile app • API for large businesses • Integration with ERP software

- 14. Benefits of E-Way Bill System • Efficient goods movement • Reduced paperwork • Prevents malpractice • Promotes digital governance • Easier compliance monitoring for tax officials