Islamic Finance 5

- 1. BUSINESS CONTRACT [AKAD] IN ISLAM & BUSINESS CONTRACT BASED ON AKAD AMANAH & TABARUAT Prepared by: Ms. Siti Nurulhuda

- 2. Learning objectives (Chapter 6) After completion of Part A, students will be able to: Define ‘Akad’ or contract accordance to Islamic perspective [language & term] Identify the needs of contract in business & explain the proof [dalil] which shows contract needs in Islamic business transaction

- 3. Learning Objectives (Chapter 6 Con’t…) Understand reason of ‘Akad’ as important law in Islamic business transaction Differentiate between Honest Contract & Musawamah & describe the contract in Contract al Musawamah Describe Contract Tabaruat Discuss Khiyar Concept in contract, types & the differences of khiyar

- 4. Introduction A business is a legally recognized organizational entity existing within an economically free country designed to sell goods and/or services to consumers or other businesses , usually in an effort to generate profit . It is also referred to as a firm Business is an occupation encourage by Islam Doing business is a practice that will be rewarded by Allah s.w.t To make the transaction legal & accordance with the Syariah Law, commandment and requirement of sales must be 100% fulfill.

- 5. SALES AKAD [AKAD CONTRACT] “ Akad” or Contract Ceremony is a symbol of willingness between the party that involve. Without “Akad” – no contract between both party. Ijab & Qabul is the symbol of willingness between both party. “ Aqad” in arabic means bonding or tie

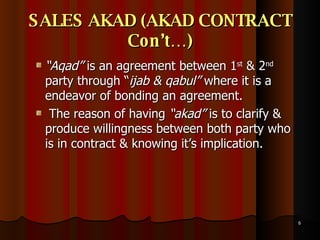

- 6. SALES AKAD (AKAD CONTRACT Con’t…) “ Aqad” is an agreement between 1 st & 2 nd party through “ ijab & qabul” where it is a endeavor of bonding an agreement. The reason of having “akad” is to clarify & produce willingness between both party who is in contract & knowing it’s implication.

- 7. Commandments in Contract of Sale’s Sighah Price Goods Buyer Seller 5 Commandments

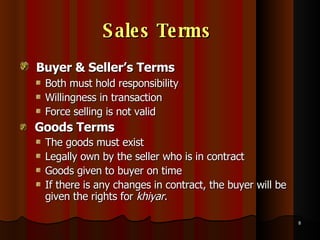

- 8. Sales Terms Buyer & Seller’s Terms Both must hold responsibility Willingness in transaction Force selling is not valid Goods Terms The goods must exist Legally own by the seller who is in contract Goods given to buyer on time If there is any changes in contract, the buyer will be given the rights for khiyar .

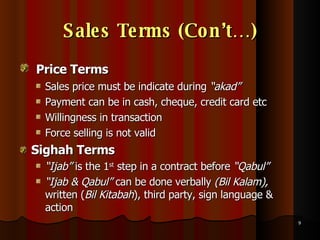

- 9. Sales Terms (Con’t…) Price Terms Sales price must be indicate during “akad” Payment can be in cash, cheque, credit card etc Willingness in transaction Force selling is not valid Sighah Terms “ Ijab” is the 1 st step in a contract before “Qabul” “ Ijab & Qabul” can be done verbally (Bil Kalam), written ( Bil Kitabah ), third party, sign language & action

- 10. Contract Ceremony (Majlis al-Aqdu) A place where both party performing sighah. Is a muamalat contract between two or more party perform in a contract or in a place where the contract is valid 4 condition in fulfilling the contract ceremony: Both party must be at the ceremony The tenor must be indicated clearly (written contract) Not to have a party who show unwillingness during contract The 1 st party must not withdraw the agreement before the 2 nd party accept the offer.

- 11. Types of Contract There are several type of contract in syariah: Looking at the Content of the Contract: “ Uberremae fidei contract”/Aqdul Amanah Contract exist from agreement without bargaining process between both party before signing the contract. The Bargaining Contract / Aqdul Musawamah Contract exist between both party through an agreement after the bargaining process. e.g: Contract of Sale & Leasing

- 12. Types of Contract (con’t…) Contract listed in this type of contract: Sales Contract (Al Bai’) Al Bai’ Bithamanil Ajil Al Ijarah Ar-rahnu Al-Murabahah Al-Musharakah Al-Wadiah Al bai’ Dayn Bai’ Inah Al Wakalah Al-Sarf

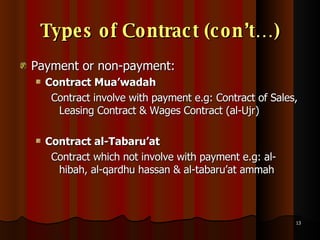

- 13. Types of Contract (con’t…) Payment or non-payment: Contract Mua’wadah Contract involve with payment e.g: Contract of Sales, Leasing Contract & Wages Contract (al-Ujr) Contract al-Tabaru’at Contract which not involve with payment e.g: al-hibah, al-qardhu hassan & al-tabaru’at ammah

- 14. Khiyar (Option) in Contract According to Wahbah al-Zuhaili, Khiyar is an option to continue or discontinue the contract due to certain circumstances. According to Sheikh Mohsin, both party were given the option to choose to continue the sales or to discontinue (fasakh) according to the rules or certain circumstances.

- 15. Principle of Khiyar (Option) According to the Syariah Law – To give a mandate in order for both party not facing losses or regrets after agreeing on the contract due to certain circumstsnces. e.g: changes in price and goods.

- 16. Types of Khiyar “ Khiyar Majlis” Each party in “Aqad” has an option towards another party as long as they are in the contract. If one party plunge their ownership, another party can still proceed with the sales or to demolish as long as “Aqad ceremony still exist”

- 17. Types of Khiyar (Con’t…) “ Khiyar Syarat” Selection being told during “Aqad” According to Imam Syafie, the terms must be clearly stated in the “Aqad ceremony” with cense of willingness and agreed between both party. If not clearly stated, it will be invalid. Tenor of “Aqad” not more than 3 days. The party who were given prerogative, can make the decision to proceed with sales or demolish within the period

- 18. Types of Khiyar (Con’t…) Khiyar Aib” Any defect on the goods (happen before “Aqad” or during sales) sold not according to the specification, the buyer can end the contract or ask for price reduction. Terms regulates to “Khiyar Aib” Defect before “Aqad” or after “Aqad” or before delivering the goods to the buyer. Buyer do not know there is a defect during “Aqad” and when purchasing the goods.

- 19. Types of Khiyar (Con’t…) Khiyar Ta’yin” The party who is in sales “Aqad” can choose one out of three goods which differentiate by the price and the characteristic of the goods. e.g: to choose from three different type of watch with different prices. Tenor of “Aqad” not more than 3 days

- 20. Types of Khiyar (Con’t…) “ Khiyar Rukyah” The buyer did not see the goods that they want to purchase. They have the right to reject (not to buy the goods). - Valid conditions of khiyar is to look at the goods.

- 21. Types of Khiyar (Con’t…) “ Khiyar Naqli” Khiyar that stated the condition on when the buyer will not pay the full payment of the total price in certain time period. Within 3 days, the agreement will be forfeit.

- 22. Types of Khiyar (Con’t…) “ Khiyar Naqli” can be forfeit due to: death of the buyer Buyer does not want to do sales through Khiyar naqli before paying the price. Buyer had damage the goods during Khiyar naqli Buyer had spoil the goods and can’t return to the seller as not paid yet. Seller can request for compensation.

- 23. Discontinuing the Contract A contract can be discontinued if: cancellation “ibtal” ended “fasakh” death of one of the party in contract Suspended contract (not fulfilling the contract’s condition)

- 24. Discontinuing the Contract (con’t…) Fasakh is a process of discontinuing or ending a contract which is actually valid. Cancellation is when the contract is invalid from the beginning due to the condition not as per Islamic perspective.

- 25. Discontinuing the Contract Through Fasakh A contract can be discontinued due to certain circumstances: Ended due to damage or desecration of contract. Ended due to Khiyar Ended (fasakh) due to not performing the contract Ended due to end of contract tenor Cancel or the contract ended due to death of one or both party.

- 26. Learning objectives (Chapter 7) After completion of Part B, students will be able to: Know various Islamic business procedures through Amanah Contract and Tabaruat Understand ways to applied Islamic business method. Identify suitable business procedures through their needs in operating their business. Discuss the instrument of Islamic finance in the market according to “Aqad amanah & tabaruat”

- 27. Introduction There are needs to be fulfill to the society from the basic needs to the high end needs. What are the basic needs? What are the steps (hierarchy of needs)? How do we get this needs?

- 28. Procedures based on Aqad Amanah A contract based on exposing detail clearly between both party in contract Both party in contract must be honest in providing the details in order to gather correct result. There are 4 types of contract under “Aqad Amanah”:

- 29. Contract al-Murabahah Also known as Deffered Lump Sum Sale Al-Murabahah financing is a financing facility for working capital to purchase stocks, inventories, replacement, semi-finish goods or raw materials. The concept is through selling goods include profit margin as agreed by both parties. Terms: The seller need to state the actual cost and capital to the buyer Both parties agreed on the profit as an additional to the actual cost.

- 30. Application Letter of Credit in al-Murabahah Principle in Bank Islam “ al-Murabahah” financing is a facility given by Bank Islam to finance their working capital by deferred payment. Customer is appointed as purchasing agent for Bank Islam. The required stocks of goods or inventory would be purchase by the customer on behalf of the bank. Upon presentation of invoice by the vendor, the bank will make payment direct to the vendor.

- 31. Application Letter of Credit in al-Murabahah Principle in Bank Islam (Con’t) The bank would sell the merchandise to the customer on deferred payment term of 30 days or other period depending on the requirement at the price which is inclusive of the bank profit margin On maturity date, the customer pays the bank at the bank’s agreed selling price

- 32. Application Letter of Credit in al-Murabahah Principle in Bank Islam (Con’t) Supplier of Goods Bank Islam Customer acting as an agent for Bank 1. Purchasing Goods 2. Supplies goods to customer 5. Settles at the Bank’s Selling price on maturity 4. Bank Sells goods on Deferred payment basis 3. Settles the purchase Price on cash basis

- 33. Application in al-Murabahah Principle in Bank Rakyat (Tijari Contract Financing) Tijari contract financing provides financial assistance to the companies to expend their business The financing adapt using the concept of al-Bai’ Bithaman Ajil, Al-Murabahah and Bai’ al-Inah with accordance to the syariah law without riba. Require security for amount above RM25k e.g: properties, shares in KLSE under syariah counter, debenture, unit trust etc.

- 34. Contract Tauliyyah Sales transaction at cost price. Amanah is important to the seller to show the cost price. e.g: grand sale Contract al-Wadziah Sales transaction below cost price e.g: old stock item, clearance sale, less unit left Contract al-Ishrak A contract sharing. Partner to reveal their details between them e.g: reveal the actual price

- 35. Procedures based on Akad Tabaruat A contract to give benefit to another party only Comprise of gift on facility to another party without stating the additional value e.g: Hadiah, Ji’alah, Hibah, al-Qardhu Hassan and sadaqah

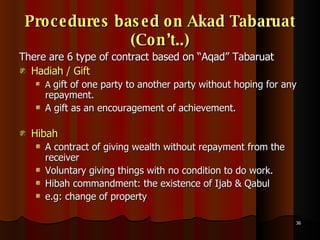

- 36. Procedures based on Akad Tabaruat (Con’t..) There are 6 type of contract based on “Aqad” Tabaruat Hadiah / Gift A gift of one party to another party without hoping for any repayment. A gift as an encouragement of achievement. Hibah A contract of giving wealth without repayment from the receiver Voluntary giving things with no condition to do work. Hibah commandment: the existence of Ijab & Qabul e.g: change of property

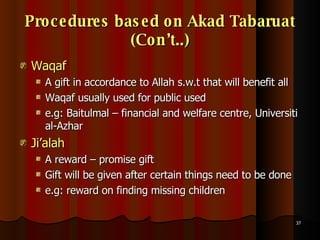

- 37. Procedures based on Akad Tabaruat (Con’t..) Waqaf A gift in accordance to Allah s.w.t that will benefit all Waqaf usually used for public used e.g: Baitulmal – financial and welfare centre, Universiti al-Azhar Ji’alah A reward – promise gift Gift will be given after certain things need to be done e.g: reward on finding missing children

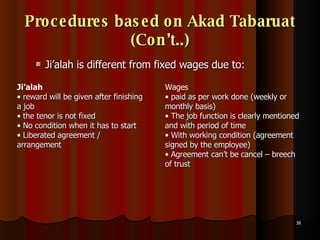

- 38. Procedures based on Akad Tabaruat (Con’t..) Ji’alah is different from fixed wages due to: Ji’alah reward will be given after finishing a job the tenor is not fixed No condition when it has to start Liberated agreement / arrangement Wages paid as per work done (weekly or monthly basis) The job function is clearly mentioned and with period of time With working condition (agreement signed by the employee) Agreement can’t be cancel – breech of trust

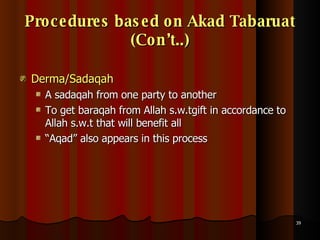

- 39. Procedures based on Akad Tabaruat (Con’t..) Derma/Sadaqah A sadaqah from one party to another To get baraqah from Allah s.w.tgift in accordance to Allah s.w.t that will benefit all “ Aqad” also appears in this process

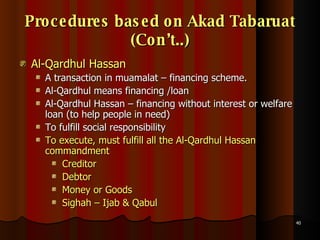

- 40. Procedures based on Akad Tabaruat (Con’t..) Al-Qardhul Hassan A transaction in muamalat – financing scheme. Al-Qardhul means financing /loan Al-Qardhul Hassan – financing without interest or welfare loan (to help people in need) To fulfill social responsibility To execute, must fulfill all the Al-Qardhul Hassan commandment Creditor Debtor Money or Goods Sighah – Ijab & Qabul

- 41. Tutorial Questions Chapter 6 (Individual) Discuss the importance of contract form the Islamic perspective Differentiate “Fasakh” and “Ibtal”. (Also to provide example) Discuss consumer’s rights in Khiyar Rukyah & Aib. (Also to provide example)

- 42. Tutorial Questions Chapter 7 (Group) Contract Al-Murabahah known as Contract “Cost+Profit”. In the banking industry, Contract Al-Murabahah is a short term financing. Kindly provide example on practices of business contract in banking based on Al-Murabahah Explain in detail: Welfare loan compared to convensional loan Al-Qard compared to Al-Qardhul Hassan Al-Qardhul Hassan in Al-Rahn business Application of Al-Qardhul Hassan in acceptance of savings account in Bank

- 43. Tutorial Questions Question 3 (Group) IJHM Consultant & Services was incorporated few years ago. The company want to expend their business by going to the bank & require financing. The company wants to buy an office outlet, more equipment, lorries & other materials . You are require to provide consultation on muamalah procedures that can be use by the company to execute in expending their business.

![BUSINESS CONTRACT [AKAD] IN ISLAM & BUSINESS CONTRACT BASED ON AKAD AMANAH & TABARUAT Prepared by: Ms. Siti Nurulhuda](https://image.slidesharecdn.com/islamic-finance-5-1204427672546182-2/85/Islamic-Finance-5-1-320.jpg)

![Learning objectives (Chapter 6) After completion of Part A, students will be able to: Define ‘Akad’ or contract accordance to Islamic perspective [language & term] Identify the needs of contract in business & explain the proof [dalil] which shows contract needs in Islamic business transaction](https://image.slidesharecdn.com/islamic-finance-5-1204427672546182-2/85/Islamic-Finance-5-2-320.jpg)

![SALES AKAD [AKAD CONTRACT] “ Akad” or Contract Ceremony is a symbol of willingness between the party that involve. Without “Akad” – no contract between both party. Ijab & Qabul is the symbol of willingness between both party. “ Aqad” in arabic means bonding or tie](https://image.slidesharecdn.com/islamic-finance-5-1204427672546182-2/85/Islamic-Finance-5-5-320.jpg)