gov revenue formsandresources forms CC_fill-in

0 likes•172 views

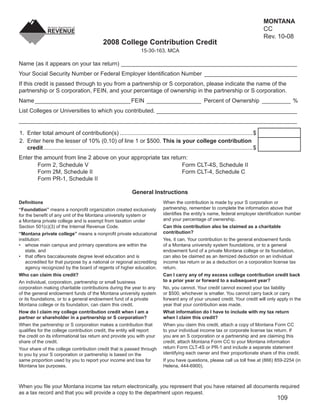

This document provides instructions for claiming the Montana College Contribution Credit tax credit. Taxpayers who make charitable contributions to Montana public or private college foundations can claim a credit worth 10% of their contributions, up to $500. The credit must be claimed in the year the contribution was made and any unused amount cannot be carried over to other years. The document outlines who is eligible to claim the credit and how partnerships or S corporations can pass the credit through to owners.

1 of 1

Download to read offline

More Related Content

Similar to gov revenue formsandresources forms CC_fill-in (20)

More from taxman taxman (20)

Ad

Recently uploaded (20)

DOCX

Navigating Environmental Excellence ISO 140012015 Implementation in Pretoria....Norocke ConsultingDOCX

India's Emerging Global Leadership in Sustainable Energy Production The Rise ...Insolation EnergyPPTX

Struggling to Land a Social Media Marketing Job Here’s How to Navigate the In...RahulSharma280537Ad