Dubai-Tech-The-Road-to-2033-Founders-Forum-Group.pdf

- 1. The Road to 2033 Dubai Tech Data partner: Investment Trends Founder Interviews Startups to Watch 1

- 2. Contents Cover images: Sonia Weymuller (VentureSouq), Sachin Dev Duggal (Builder.ai), Nour Al Hassan (Tarjama) Dubai Tech: The Road to 2033 Foreword I By Carolyn Dawson, CEO Founders Forum Group 3 Foreword II By Hadi Badri, CEO Dubai Economic Development Corporation Dubai Department of Economy & Tourism 4 Dubai Tech: In Numbers 6 Dubai Tech: The Road to 2033 1) The Innovation Ecosystem Featuring: Nadine Mezher (Sarwa), Niklas Ostburg (Delivery Hero) & Rasmus Rothe (Merantix) 2) Corporate-Startup Collaboration Featuring: Chris Sheldrick (what3words) & Linnéa Kornehed Falck (Einride) 3) Talent Featuring: Alex Bouaziz (Deel), Mona Ataya (Mumzworld), Nour Al Hassan (Tarjama) & Steve Papa (Parallel Wireless) 4) Capital Featuring: Dany Farha (BECO Capital), Noor Sweid, (Global Ventures), Rana Abdel Latif (Speedinvest) & Sonia Weymuller (VentureSouq) 5) Access to Growth Markets Featuring: Abdulla Almoayed (Tarabut), Jad Antoun (Huspy) & Sachin Dev Duggal (Builder.ai) 7 Expanding in Dubai: Legal Checklist 67 Supporting Global Tech Founders in Dubai Saeed Al Gergawi, Vice President, Dubai Chamber of Digital Economy 72 Startups to Watch 75 Methodology 90 2

- 3. OurmissionatFoundersForumGroupistosupport entrepreneursateverystageoftheirjourneys,whereverthey areintheworld. InFebruary2024,wehostedourinauguraleventinDubai,in partnershipwithDET,gathering100oftheworld’smost impactfulfounders,investors,andcorporateandgovernment leadersinacitycharacterisedbyitsgrowingaccessto capital,advantageouslocation,cultureofinnovation, supportivebusinessenvironment,andforward-thinking investments. Aswesetplansinmotionforour2025event,weknewwe neededtogobigger.TheMEASA(MiddleEast,Africa,and SouthAsia)regionishometomorethanhalftheworld’s populationandacombinedGDPof$7.7trillion–andDubaiis atitscentre,withathirdoftheworldwithinafour-hourflight, atimezonethatbridgesthegapbetweenEastandWest,and abusinessenvironmentwhichrankstopgloballyfor entrepreneurship,talent,andinvestment. That’swhythisyearwereturntoDubaiwithDETandFF MEASA,ourlatestflagshipforumandourbiggesteventinthe regiontodate,providingourcommunitywithcuratedaccess tothevibrantinvestmentandinnovationecosysteminDubai andbeyond. We’resteppingupourwiderbusinessactivitiesintheregion too.FoundersLaw,alawfirmwhichpartnerswithhyper- ambitiouscompaniestoacceleratetheirgrowthfromideato exit,hasbeenworkingwithclientsacrosstheGCCforawhile, butrecentlygainedalicencetoopentheirofficesinthe MiddleEast,basingthemselvesinDubaiandsupporting companiesandfoundersastheyenterandexpandacrossthe region. Similarly,FoundersMakers–acreativepartnertostart-ups andscale-ups,offeringexpertiseinbranding,campaignsand content–hasbeenexpandingitsfootprintintheregion.The agencyhassecurednewclientsacrosssectorssuchas financialservicesandfoodandbeverage.Theysupport locallyscalingbusinesses,andassistinternationalbrands aimingtoestablishapresenceinthearea. Therearestillopportunitiestouncover.Byopeningup opportunitiesforglobaltalentandwomenentrepreneurs, drivinginvestmentinclimatetech,sustainability,andAI,and unlockingscale-upcapital,wecanensurethatDubai continuesto,notjustparticipateintheglobaltechecosystem, butactivelyshapeitsfuture. Dubai Tech: The Road to 2033 FOREWORDI TheDubaitechecosystemhasreacheda combinedmarketvaluationof$43billion, blazingatrailasadynamicdestinationfor techinnovationandaspringboardfor globalfounderstoexpandtheirbusinesses acrossthewiderMEASAregion. Readontodiscoverthetrendsshapingthe futureofDubaitech! CarolynDawson CEO FoundersForumGroup AsDubaisetsouttoachieveitsambitiousgoalssetoutinthe landmarkDubai Economic Agenda (D33)–todoubleitsGDP andbecomeoneofthemostimportanteconomiccitiesinthe worldby2033–Dubai’sroleinbringingglobalcommunitiesof techinnovatorstogetherwillbekey. InourDubai Tech: The Road to 2033 report,publishedin partnershipwithDubaiDepartmentofEconomyandTourism (DET),wedeep-diveintothedataanduncoverinsiderinsights fromtopinvestorsandglobalunicornfounderstoprovidea comprehensivemarketoverviewforfounderslookingto expandintheregion. Weexplorethefivekeypillarsthatformthefoundationof Dubai'sthrivingtechsceneandtheroadto2033–arobust innovationframework,synergisticcorporate-startup collaborations,adiversepoolofworld-classtalent,abundant capitalresources,andaccesstomajorgrowthmarkets.Plus, welistourtop40Dubaitechstartupstowatch! 3

- 4. Dubai’s commitment to innovation is evident in its unparalleled infrastructure, investor-friendly policies, and its ability to attract the brightest talent and ideas. FF MEASA exemplifies this synergy, bringing together the world’s most impactful entrepreneurs and investors in a collaborative environment that embodies Dubai’s entrepreneurial spirit. To all founders: Dubai is more than just a destination. It is your platform to scale, your partner in growth, and your launchpad for building transformative businesses that will shape the future. Let us innovate, collaborate, and chart a bold course for global entrepreneurship – together. As we convene in Dubai for the flagship FF MEASA, it is fitting that we celebrate the shared values that have propelled both this city and this global community of innovators to the forefront of shaping the future. The journey of Founders Forum Group, from its roots in London to its expanding global footprint, mirrors Dubai’s own evolution. Just as this forum has become a dynamic platform for collaboration, Dubai has transformed from a modest trading hub to a global beacon of entrepreneurship and innovation. Today, it stands as the gateway to the MEASA region and the world. At the heart of Dubai’s vision is the Dubai Economic Agenda (D33), a decisive roadmap to double the city’s GDP by 2033 and establish it as one of the top three global hubs for business and innovation. Central to this ambition is nurturing the next wave of disruptors: we are aiming to accelerate 30 unicorns from Dubai by 2033, and initiatives like Sandbox Dubai and the AI Blueprint are setting the stage for these startups to flourish. In the coming months, we will unveil flagship initiatives designed to fuel early-stage growth, identifying and accelerating startups and SMEs across industries. Our focus is clear: to provide entrepreneurs with a robust support ecosystem, seamless access to international markets, and resources to scale faster and smarter. Dubai is a citybuilt on ambition, resilience, and a relentless pursuit of progress – qualities that resonate deeplywith the founders, entrepreneurs, andvisionaries gathered here. HadiBadri CEO Dubai Economic Development Corporation Dubai Department of Economy & Tourism Dubai Tech: The Road to 2033 4 FOREWORD II Choose Dubai as your home for ambition and achievement.The future is being built here, andwe invite you to be part of it.

- 5. 5

- 6. Dubai Tech In Numbers Dubai Tech: The Road to 2033 1st The UAE is ranked first in the Global Entrepreneurship Monitor’s index Source:GEM 1st Dubai is ranked first globally for attracting greenfield foreign direct investment Source:fDiInsights 3rd best city in the world for global talent Source:BCG $43 billion The value of Dubai's tech ecosystem in Q4 2024 Source:Dealroom 10 Unicorns produced in Dubai - companies valued at more than $1 billion. Source:Dealroom 62 Gbps Dubai offers the fastest 5G globally Source:ZAWYA $31 billion Dubai's GDPin Q1 2024 Source:DigitalDubai +3.2% GDPgrowth year-on-year in Q1 2024 Source:DigitalDubai x2 Dubai plans to double its GDPby 2033 Source:DubaiEconomic AgendaD33 6

- 7. Dubai Tech The Road to 2033 Dubai Tech: The Road to 2033 7

- 8. Dubai Tech: The Road to 2033 In January 2023, Dubai announced the Dubai Economic Agenda (D33), a landmark economic plan to boost trade and investment, double Dubai's GDP by 2033, and make Dubai one of the top three most important economic cities in the world. At its core is the development of new groundbreaking technologies, like AI and robotics, to turbocharge green industry, logistics, and financial services, supported by flexible, pro- innovation policies and connections to global growth markets. Dubai wants to generate $27b from digital transformation projects each year, and nurture 30 home-grown unicorn companies by 2033. To start and scale their businesses, founders need access to talent, investment, markets, and the latest infrastructure to grow. Strategically located at the crossroads of Europe, Asia, and Africa, Dubai has become an increasingly attractive hub for founders of tech companies, from startups to unicorns, based on five key pillars that will define the future of its thriving tech ecosystem. The five key pillars of Dubai tech: 1 The Innovation Ecosystem Business-friendly policies, future industries, and startup hubs. 2 Corporate-Startup Collaboration Synergistic relationships between startups and corporations. 4 Capital Abundant capital resources and the world's fastest- growing VC ecosystem. 3 Talent A diverse pool of global, world-class tech talent. 5 Access to Growth Markets Connections to fast- growing markets in MEASA and beyond. 8

- 9. Dubai Tech: The Road to 2033 The Innovation Ecosystem From startup hubs to sandboxes and economic free zones, Dubai's business-friendly tech scene is attracting disruptive companies to the city and ushering in new waves of innovation across technologies like AI, web3, and the metaverse. But the rapid development of a thriving innovation ecosystem doesn't come without its challenges. 1 x2 Dubai plans to double its GDP by 2033 in its landmark Dubai Economic Agenda (D33). Source: u.ae x2 Dubai plans to double its GDP by 2033 in its landmark Dubai Economic Agenda (D33). Source: u.ae 99% of the UAE population have access to the internet. Source: DataReportal 99% of the UAE population have access to the internet. Source: DataReportal 7th The UAE is ranked seventh in the world for its adoption of digital technologies. Source: IMD World Competitiveness Ranking 7th The UAE is ranked seventh in the world for its adoption of digital technologies. Source: IMD World Competitiveness Ranking $96 billion AI is projected to contribute up to $96b to the UAE economy by 2030 (13.6% of GDP). Source: PwC $96 billion AI is projected to contribute up to $96b to the UAE economy by 2030 (13.6% of GDP). Source: PwC 9

- 10. Dubai Tech: The Road to 2033 Sandbox Dubai Launched as part of the D33 Agenda, the Sandbox Dubai initiative aims to turn Dubai into a world-leading incubator and testing ground for future tech. In sandbox environments, new technologies go through live testing phases with oversight from regulators before being granted licences for production and distribution. The UAE’s ICT Regulatory Sandbox, the first experimental legislative environment for the ICT sector, began operations in August 2024. In October, Dubai Future Foundation launched two new sandboxes in the gig economy and proptech. Meanwhile, fintech companies can apply for the Dubai Financial Services Authority’s Innovation Testing Licence (ITL) and test new products and business models in the ITL sandbox programme. RegLab Dubai’s sandboxes are backed by the UAE Regulations Lab, or RegLab, designed to pioneer ‘regulation innovation’ by co- developing new or existing legislation around emerging technologies. Companies can apply for public sector backing for a product or concept, and then work together with regulators on legislative frameworks to help their tech applications succeed. RegLab has issued various licences – to test self-driving vehicles, for example; electric cargo aircraft; new innovations in insurtech; and a temporary licence to the United Parcel Service to test electric vertical takeoff and landing aircraft in the UAE. Dubai’s pro-innovation regulation is a defining feature of the city’s tech ecosystem, allowing for the testing and marketing of new disruptive technologies in ways which would be difficult to replicate elsewhere. Pro-Innovation Policies 10

- 11. Dubai Tech: The Road to 2033 Public Private Partnerships Dubai’s PPP model provides a legal framework for government agencies to enter into partnership contracts with private sector companies as both sides work hand-in-hand to support the tech ecosystem. Deel, for example, partnered with the UAE’s Office for AI, Digital Economy and Remote Work Applications to offer faster access to foreign workers visas. In March 2024, Dubai announced a new portfolio of PPP projects worth more than $10b across key sectors including health, education, finance, and technology. Dubai Unified Licence The Dubai Unified License is a unique digital passport for all companies operating across the city’s free economic zones, where founders can incorporate and run new companies easily and tax efficiently. Companies can operate out of multiple free zones under the licence, which provides a single source of information for customers, suppliers, and service providers to view the details of any business operating in the city. Tax Incentives Dubai’s business-friendly tax system means companies benefit from tax and custom duty exemptions, VAT refunds, and access to free zones. There is no personal income tax in Dubai; 0% VAT charges on sales outside the Gulf states; and 9% corporate tax on income above $100k, one of the lowest corporate tax rates in the world. Dubai 10X Dubai Future Foundation’s Dubai 10X promotes large-scale, future-looking projects to improve government services, solve major challenges, and position Dubai 10 years ahead of the rest of the world. Dubai 10X powered the creation of Digital DEWA, the digital arm of Dubai Electricity & Water Authority, and Dubai Blink, the world’s first B2B smart commerce platform for economic free zones. His Excellency Helal Almarri (Dubai Department of Economy & Tourism) 11

- 12. Dubai offers a gateway to rapidly growing markets with increasing urbanisation, digitalisation, and business-friendly policies. Dubai Tech: The Road to 2033 Niklas Östberg Delivery Hero Founded 2011 Employees 43,000+ Stage Listed on the the Frankfurt Stock Exchange Niklas is Co-Founder & CEO of Delivery Hero, the world’s leading local delivery platform, operating marketplace, own-delivery, and dark store (Dmarts) business, reaching a population of over 2 billion people in around 70 countries across four continents. Delivery Hero’s Middle Eastern unit, talabat, has grown into a leading food delivery and quick commerce business in Dubai and across the MENA region. 12

- 13. Dubai Tech: The Road to 2033 What’s Next? In 2023 alone, talabat achieved over $6b in sales, with double-digit growth and strong profitability. Our goal is to continuously refine our value proposition to meet our customers’ needs, and as a result, we have built an increasingly loyal customer base. Looking ahead, we plan to expand our services to cover more areas of our customers’ lives, with the aim of becoming a super app across the region. Why Dubai? Dubai has cultivated a unique environment where public initiatives support technological innovation and entrepreneurship, making it easier for companies to operate and grow. People in Dubai are also quick to adopt technology and welcome innovative ‘everyday’ solutions, which we have seen with food and grocery delivery from our talabat brand in MENA. Being open to new ideas and technologies makes Dubai an ideal hub to do business and setting up and expanding here is straightforward. Expanding in Dubai One of Dubai’s biggest benefits is easy access to a diverse talent pool, as Dubai draws skilled professionals from around the world. Having a business-friendly environment simplifies the process of launching and managing a business, and the city’s robust infrastructure helps companies to set up quickly and efficiently. A key learning that talabat exemplifies is the importance of localisation which has helped it to grow into a category leader. Adapting its offerings to align with local culture and preferences has been essential. Dubai's strategic location and its strong connections across the Middle East also make it an ideal launchpad for regional expansion. Mona Kattan (Huda Beauty), Niklas Ostburg (Delivery Hero) & Michael Lahyani (Property Finder) 13

- 14. Dubai Tech: The Road to 2033 AI The UAE AI market was valued at $3.47b in 2023 and is projected to grow at a CAGR of 43.9% between 2024 and 2030. Plus, businesses in the UAE are actively implementing AI – 65% of IT professionals in the UAE have expedited an AI rollout over the past two years. The adoption of AI could contribute up to 13.6% of the UAE’s GDP by 2030, around $96b. Dubai is home to 350+ VC-backed AI companies including AI and blockchain developer, Sentient Labs, automated investment platform, Sarwa, and retail tech startup, DTEK. In April 2024, the Dubai government unveiled the Universal Blueprint for Artificial Intelligence to accelerate the adoption of AI. Phase one involved the appointment of 22 chief AI officers (CAIOs) for key government departments and the launch of a major AI and web3 startup incubator. The UAE was the first country in the world to appoint a Minister of AI and the UAE National Strategy for AI aims to position the country as the world leader in AI by 2031. The Dubai Robotics and Automation Programme aims to increase the sector's contribution to Dubai’s GDP to 9% and roll-out 200,000 robots across the city by 2032, while the DIFC Innovation Hub’s Dubai AI Campus offers an AI accelerator programme with the ambition to attract more than 500 tech companies and $300m in funds by 2028. In 2024, the Dubai Multi Commodities Centre (DMCC) launched a new AI Centre to drive global, practical AI solutions. The AI Centre is part of a newly integrated hub alongside DMCC’s established technology ecosystems, the DMCC Crypto Centre and DMCC Gaming Centre. The rise of AI in the UAE is backed by a growing ecosystem of cloud providers and data centres. Dubai is the number one data centre market in the UAE, with 18 data centres and 230+ cloud service providers. Multinational tech companies, including AWS, Microsoft, and SAP, have data centres in Dubai. Dubai is emerging as a world centre for crypto, digital assets, and AI, backed by government initiatives and a flexible and proactive regulatory regime. Driving Future industries 14

- 15. Dubai Tech: The Road to 2033 Metaverse The Dubai Metaverse Strategy aims to turn Dubai into one of the world’s top 10 metaverse economies, add $4b to Dubai's GDP, and create more than 40,000 virtual jobs in the blockchain and metaverse sectors by 2030. DIFC’s first Metaverse Accelerator Programme attracted 160+ applications from founders globally and onboarded 10 companies for an intensive, three-month startup bootcamp. Companies include Artichoke Labs, a spatial computing company specialising in creating city-scale augmented reality applications, Daoversal, an expansive web3 social ecosystem platform, and more startups innovating across the IoT, healthcare, edtech, the creative industries, and AI. Web3 Dubai’s Virtual Assets Regulatory Authority (VARA) is the world’s first independent regulator of virtual assets, like cryptocurrencies and NFTs, and launched a landmark licensing framework for virtual asset service providers in 2023. Investors sent $34b in crypto transfers to the UAE between 2023 and 2024. VARA has awarded full regulatory approvals to global crypto exchanges such as OKX, Crypto.com, and Binance in the past year. Dubai's gaming sector is targeting 30,000 new jobs and a $1b contribution to GDP by 2033. The DMCC Gaming Centre provides more than 100 gaming startups with an ecosystem of support and funding opportunities. FinTech The UAE fintech market was valued at $3b in 2023 and is expected to reach $5.7b by 2029 More than 1,000 fintech firms are registered in the Dubai International Financial Centre (DIFC) and they’ve raised $3.3 billion in venture funding between them DIFC’s Innovation Hub is home to Fintech Hive, the first and largest fintech accelerator in MEASA, connecting startups with the region’s largest financial services firms, banks, and insurance companies. Fintech Hive’s 200 startup alumni have raised more than $600m in funding and include the likes of Norbloc, Sarwa, Tarabut Gateway, and Zywa. 15

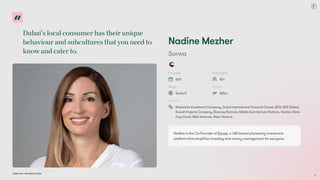

- 16. Dubai’s local consumer has their unique behaviour and subcultures that you need to know and cater to. Dubai Tech: The Road to 2033 Nadine Mezher Sarwa Founded 2017 Employees 50+ Stage Series B Raised $25m Investors Mubadala Investment Company, Dubai International Financial Center, ADQ, 500 Global, Kuwait Projects Company, Shorooq Partners, Middle East Venture Partners, Hambro Perks Oryx Fund, HALA Ventures, Vision Venture Nadine is the Co-Founder of Sarwa, a UAE-based pioneering investment platform that simplifies investing and money management for everyone. 16

- 17. Dubai Tech: The Road to 2033 Expanding in Dubai Make sure you understand the market before entering it. Start with your market research and understanding of the legal requirements of what you are trying to build. The legal and regulatory framework is different, with its free zones and mainland regulations. This allows for flexibility but also adds a layer of complexity. Make sure you know the pros and cons of each zone to choose where to start. Build your network, invest time in relationships, and talk to other founders who have been through what you are trying to build. They will know the paint points and have gone through the challenges. If you are building a team, make sure you bring people on board who understand the local market if that’s your target. It is a beautiful place to launch a product, but make sure you understand the cultural and behavioural nuances of the different personas and that you tailor offerings and messages to resonate. What’s Next? Sarwa keeps evolving as we grow. We started as a small team with a vision to democratise investing and money management in the MENA region, offering one product. Today, we serve thousands of clients and have expanded our offerings to include various financial products. Our plan is to continue growing our client base and continuously enhancing our platform with advanced technology and customer feedback to better serve them, while adding more and more value and products. Why Dubai? Dubai is a city that is always forward-thinking. It has a startup mindset itself, and because of that it offers so much. The Dubai government is always promoting entrepreneurship through many initiatives and also offers an environment of ease of business. You have free zones and regulatory sandboxes with a conversational approach to law-making, streamlined business setup processes, and a generally supportive framework for innovation. It is the reason we decided to launch Sarwa out of Dubai. Most importantly for us, Dubai is a city of early adopters and a young population with high digital penetration: perfect ground for testing any new ideas. Generally, you have your venture capitalists, angel investors, and government-backed funding initiatives close by, and within proximity to the regulators. The city also provides easy access to markets in the Middle East, Africa, and Asia, and you have a great pool of super-talented people here from different backgrounds, offering diversity and experience, while also having affinity to the sub-cultures in the market. 17

- 18. WeseeDubaiasagreatplacetogrowour ecosystem,andwe’recontinuallyworkingto buildstrategicrelationshipsinDubai’s growingAIlandscape. Dubai Tech: The Road to 2033 Rasmus Rothe Merantix AUM $140m Focus AI Stage Pre-Seed-Seed Ticket Size $500k-$3m Portfolio Includes Briink, Cambrium, Company Shield, Deltia, Ficus Health, Graph Therapeutics, Libra, Ovom Care, Vara Rasmus is Co-Founder & General Partner of Merantix Capital, a Berlin-based venture capital firm and a unit of Merantix, a group of companies and initiatives driving AI forward in Europe. Now, he’s looking to support the development of the AI ecosystem in Dubai. ©Jan Schoelzel 18

- 19. Dubai Tech: The Road to 2033 Expanding in Dubai In Berlin, our Merantix AI Campus is home to 300+ annual events and more than 80 resident companies, and so we’re constantly exploring new opportunities to expand that footprint in new geographies, whether that’s through events, strategic partnerships, or startup and market entry programs. Down the road, as the AI ecosystem continues to grow in Dubai, the sky really is the limit for what our presence here could look like. Advice For Founders Entering this market is about building strong and genuine relationships, whether participating in industry events or just meeting people to catch up. Meaningfully integrating into the local ecosystem and nurturing the relationships you make is the best and most rewarding way to do business here. Why Dubai? The hardest thing for founders to find when starting a new company is talent and customers. Firstly, Dubai has created an environment that is luring in top talent, which is critical for AI development and maintaining a diverse and skilled workforce. Then on the customer side, increased collaboration between corporates and startups is allowing early-stage ventures to get that crucial ‘stamp of approval’ from established partners on their new solutions. The influx of talent and capital here plus the government’s willingness to move quickly and transform is really attractive to AI companies and investors. In general, it's been inspiring to witness Dubai’s emergence as a growing hub for technology and innovation. There’s a real passion here for digital transformation and creating modern infrastructures, as well as a general sense of optimism which can sometimes be lacking in the western world. Dubai is appealing thanks to the core interest here in driving AI forward and creating an environment where new ideas and startups can experiment and flourish. Initiatives like the Dubai AI Campus, AI offices in government, and UAE sovereign wealth funds’ backing of AI companies demonstrates the commitment. 19

- 20. Dubai Tech: The Road to 2033 This map graphic shows just a small portion of Dubai’s mammoth ecosystem of startup programmes, accelerators, and incubators. Click here for the complete Dubai Startup Guide. Dubai Silicon Oasis A 15-minute city for business and sustainable living, dedicated to fostering knowledge and innovation. 90,000+ community residents and entrepreneurs, plus 30,000+ registered companies, are based in the 7 square kilometre city, where businesses can test new technologies at scale, from robotics and smart city integrations to autonomous cars. Intelak A tech innovation hub that supports startups in the aviation and travel sectors with education, mentorship, and resources. Dubai Future Accelerators An intensive nine-week accelerator programme bringing startups, private entities, and government together to tackle challenges relevant to Dubai’s technological future. Dubai International Financial Centre’s (DIFC) Innovation Hub The largest financial innovation ecosystem in the region, home to more than 1,000 innovative tech firms, VCs, and regulators, plus the first and largest fintech accelerator in the MEASA region. Dtec The largest tech startup coworking campus in the Middle East. Dtec also runs SANDBOX, a 12-month scale-up programme for tech founders. Dubai Internet City The region's largest technology and business hub, and a free economic zone, designed to facilitate and promote IT systems and services throughout the UAE. Astrolabs The Gulf’s leading business expansion programme, supporting the expansion of high-growth businesses to the UAE. Dubai Multi Commodities Centre (DMCC) A global hub for business, trade, and commerce, home to 24,000 companies ranging from startups to multinationals. Its tech ecosystems focus on fast- growing sectors, including crypto, gaming, and AI, giving startups access to funding, talent, office space, and flexible licensing solutions. Spanning just over 1,500 square miles, the Dubai landscape is dotted by hundreds of incubators, accelerators, co-working hubs, and special economic free zones designed to turbocharge the city’s startup scene. Startup City 20

- 21. Dubai Tech: The Road to 2033 Cybersecurity As tech advances rapidly across the Middle East, businesses are also experiencing an increase in cyber attacks and traditional companies with legacy systems are in need of new solutions to support their digital transformations and keep their systems secure. This is opening up huge opportunities for entrepreneurs, especially in the UAE where the cybersecurity sector is expected to reach $1.07b by 2029. Navigating Regulation While Dubai offers a pro-business regulatory environment, navigating the intricacies of local laws and regulations can be daunting. Founders Law, which offers frictionless, relationship- driven legal support specifically for tech founders in the UK, is now looking to Dubai to expand its operations and support more scaling companies as they develop, protect, launch, and scale pioneering products and services. Founder Insights 21

- 22. Dubai Tech: The Road to 2033 Corporate-Startup Collaboration Multinationals and Big Tech firms, from Mastercard to Microsoft, are setting up headquarters in Dubai and fueling a city-wide melting pot of corporate-startup activity – including accelerators, bootcamps, and joint ventures – often facilitated by the Dubai government. In the past year alone, we’ve seen a flurry of corporate initiatives and partnerships driving Dubai’s startup ecosystem forwards. 2 +200% YoY growth in the number of multinational companies setting up offices in Dubai in H1 2024. Source: Emirates News Agency +200% YoY growth in the number of multinational companies setting up offices in Dubai in H1 2024. Source: Emirates News Agency $3b+ Corporate VC investment into Dubai-headquartered startups in the past five years. Source: Dealroom $3b+ Corporate VC investment into Dubai-headquartered startups in the past five years. Source: Dealroom $1.5b Invested by Microsoft in UAE AI company, G42. Source: Microsoft $1.5b Invested by Microsoft in UAE AI company, G42. Source: Microsoft 22

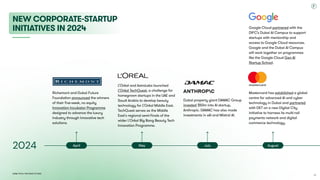

- 23. Dubai Tech: The Road to 2033 2024 Google Cloud partnered with the DIFC’s Dubai AI Campus to support startups with mentorship and access to Google Cloud resources. Google and the Dubai AI Campus will work together on programmes like the Google Cloud Gen AI Startup School. Mastercard has established a global centre for advanced AI and cyber technology in Dubai and partnered with DET on a new Digital City initiative to harness its multi-rail payments network and digital commerce technology. August Richemont and Dubai Future Foundation announced the winners of their five-week, no equity Innovation Incubator Programme designed to advance the luxury industry through innovative tech solutions. April L’Oréal and AstroLabs launched L’Oréal TechQuest, a challenge for homegrown startups in the UAE and Saudi Arabia to develop beauty technology for L’Oréal Middle East. TechQuest serves as the Middle East's regional semi-finals of the wider L'Oréal Big Bang Beauty Tech Innovation Programme. May Dubai property giant DAMAC Group invested $50m into AI startup, Anthropic. DAMAC has also made investments in xAI and Mistral AI. July New Corporate-Startup Initiatives in 2024 23

- 24. Dubai Tech: The Road to 2033 Uber and WeRide partnered to bring WeRide’s autonomous vehicles onto the Uber platform, beginning in the UAE. Uber has also partnered with the UAE’s Al-Futtaim Electric Mobility Company to give drivers access to a wide selection of electric and hybrid vehicles and progress its commitment to having 25% of kilometres driven on its platform in Dubai to be emission-free by 2026. Bolt partnered with Dubai Taxi Company to launch the UAE’s largest e-hailing platform, bringing together DTC’s fleet of over 6,000 vehicles and Bolt’s advanced global mobility platform. October Meta and the Dubai Future Foundation announced the first cohort of the Llama Design Drive, an AI Accelerator powered by Startupbootcamp, targeting corporates and startups across the MENA region. Companies tap into Meta’s open-source LLM, Llama 3.1, for innovation and product development across three four- week sprints. September Amazon has partnered with the Dubai Department of Economy and Tourism (DET) to launch the new DET x Amazon Accelerator and propel the growth of SMEs in Dubai. The accelerator will provide Dubai- based businesses with advanced digital tools and strategic growth opportunities to reach millions of customers through Amazon UAE. Insurance marketplace, Lloyd’s, and DET announced the first cohort for their new insurtech accelerator, which provides Dubai-based startups with a pathway to access the London market. Startups include Artio, which provides insurance products for carbon projects, and embedded insurance platform, Discovermarket. 24

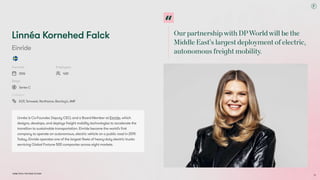

- 25. Our partnershipwith DPWorldwill be the Middle East’s largest deployment of electric, autonomous freight mobility. Dubai Tech: The Road to 2033 Linnéa Kornehed Falck Einride Founded 2016 Employees 400 Stage Series C Investors EQT, Temasek, Northzone, Barclay’s, AMF Linnéa is Co-Founder, Deputy CEO, and a Board Member at Einride, which designs, develops, and deploys freight mobility technologies to accelerate the transition to sustainable transportation. Einride became the world’s first company to operate an autonomous, electric vehicle on a public road in 2019. Today, Einride operates one of the largest fleets of heavy-duty electric trucks servicing Global Fortune 500 companies across eight markets. 25

- 26. Dubai Tech: The Road to 2033 Expanding in Dubai Einride’s approach to deploying in the UAE is region-wide. The Falcon Rise grid will deploy Einride’s full freight mobility offering, providing over a stretch of 550 km across Abu Dhabi, Dubai, and Sharjah, encompassing 2,000 electric trucks, 200 autonomous trucks and eight charging stations with over 500 charging points – all powered by Einride’s digital freight platform. Given the vast rollout of the plan, government support is critical. In May 2023, an MoU with the UAE’s Ministry of Energy and Infrastructure was signed, with a second MoU with the Abu Dhabi Integrated Transport Center following in February 2024. The MoUs showcase support from a governmental level in both deploying the technology but also in developing the regulation needed to do so, which will then help support ongoing conversations with shipper customers to start operations within the Falcon Rise grid. What’s Next? The first shipper customer we announced was DP World, with operations set to kickoff shortly. Einride’s partnership with customer DP World, announced in May 2024, will be the Middle East’s largest deployment of electric, autonomous freight mobility. Starting in Q1 2025, the partnership will scale up to support approximately 1,600 container movements daily, which in turn will look to reduce 14,600 tonnes of CO2e annually. A fleet of connected electric trucks will operate 24/7 out of Jebel Ali Port, and an autonomous pilot is slated for deployment in the latter half of 2025. Advice For Founders Working with government support is an important aspect of being in the region, as it ensures access to funding, a network of resources, and regulation support. But there is such a strong payoff given the UAE has set up incentives for international companies to invest in the region and deploy new technologies. This has then turned it into an excellent spot to test out new technology, so don’t hesitate to see it as a test bed to bring ideas to life in an impactful way. Why Dubai? The UAE region overall has presented an attractive case specifically in two areas: its high ambitions in investing in new, disruptive technologies, and its governmental bodies that are implementing supportive regulation to put the technology into action, like Dubai’s goal for 25% of all transportation to be autonomous by 2030. Dubai is at the forefront of innovation, with ambitions to create a future powered by disruptive solutions and we believe that Einride can, and will, serve as a great partner in this work.

- 27. SpearheadedbyourpartnershipwithAramex, ourwhat3wordsecosystemisbringing precisionandefficiencytobusinessesand individualsacrosstheGulf. Dubai Tech: The Road to 2033 ChrisSheldrick what3words Founded 2013 Employees 100+ Stage SeriesC Raised £100m+ Investors Intel,Ingka(Ikea),Mercedes-Benz,Aramex,DeutscheBahn,Subaru,SonyInnovationFund ChrisisCo-Founder&CEOofwhat3words,asimplewaytotalkaboutprecise locations.what3wordsenablesuserstoeasilyshareverypreciselocationswith otherpeople,ortoinputthemintoplatformsandmachinessuchasride-hailing appsore-commercecheckoutsandcarnavigationsystems.Customers includeJaguarLandRover,Subaru,Lamborghini,DPD,DHL,andAramex inDubai. 26

- 28. Why Dubai? The region’s booming logistics and e- commerce industry presents exciting opportunities for our technology. Inadequate addressing remains a headache for these businesses, as many live in large apartment complexes with multiple entrances, or newly-built developments pending official addresses, causing deliveries to be delayed or fail, ultimately raising costs. Our technology offers a simple solution: we’ve divided the globe into 3m squares, and assigned each one a unique combination of three words, giving every front gate, side door, parking space and hidden entrance to a secluded residence an accurate and easily communicable address. Since introducing what3words to the region in 2016, spearheaded by our partnership with Aramex, our ecosystem has expanded at pace, bringing precision and efficiency to businesses and individuals across the Gulf. Expanding in Dubai It’s been remarkable to see what3words’ growth in the region. In 2017, we conducted a delivery test with our partner Aramex in Dubai, which found that using a what3words address was 42% faster than street addresses. Seven years on, and many partnerships later, over 20 logistics and fulfilment companies in the region have adopted the technology, including early what3words-investor Aramex, IQ Fulfilment, Shipa, as well as Zajel, which utilises the technology for accurate delivery of government issued documents. Over nearly a decade of working in the region, we have learnt a huge amount about the nuances of the market from other founders, investors and mentors. Understanding the importance of engaging directly with the culture has been crucial – it’s helped us identify specific pain points surrounding location information that locals deal with on a daily basis. Dubai Tech: The Road to 2033 Alongside our Gulf team’s dedication towards growing our partner ecosystem, a key factor in what3words’ success has been the region’s tech-savvy population and receptiveness to innovation. We have had fantastic feedback from users, who have used the technology to remedy numerous issues commonly faced during deliveries, like directing couriers to specific locations such as side doors and hidden entrances without the need for long and frustrating phone calls. What’s Next? We will continue to work towards making what3words an addressing standard. As the region’s appetite for innovative solutions grows, we see even greater potential for what3words to scale across different sectors – from logistics and e-commerce, to tourism and smart city development projects. 27

- 29. Dubai Tech: The Road to 2033 Advice For Founders 1. Local experts & travel A crucial step in setting up what3words’ operations in the Gulf was hiring Arabic-speaking local experts with deep understanding of the region, guiding us through its unique business landscape. We’ve also invested significant time on the ground, with team members frequently travelling across the region for in-person meetings, helping to build valued relationships. 2. Localisation, localisation, localisation Simply making your product available in Arabic isn’t enough to convince a market – it’s essential that your offering is culturally relevant, built on solid insights and solves a real problem faced by consumers and businesses. 3. Network Simply making your product available in Arabic isn’t enough to convince a market – it’s essential that your offering is culturally relevant, built on solid insights and solves a real problem faced by consumers and businesses. 28

- 30. Dubai Tech: The Road to 2033 Read a startup guide to securing corporate partnerships by Founders Factory. Regional Opportunities There are other growing business hubs in the Middle East. Saudi Arabia has urged companies seeking government contracts to set up their regional HQs in the Kingdom, and PepsiCo, PwC, and Unilever are among 350 global companies that have recently obtained licences to do so. Dubai must continue to promote its friendly and innovative business environment to attract and retain the biggest global firms. Partnership Problems Less than 30% of startups who responded to a corporate-startup study by McKinsey said they were happy with their corporate partnerships. Any corporate-startup partnership can be a struggle, with contrasting priorities, structures, and ways of working – and that’s compounded when different cultures and languages meet. Founders partnering with companies in Dubai should choose their partners strategically, set common goals, and tap into local talent to ensure their offerings align with regional preferences. Founder Insights 29

- 31. Dubai Tech: The Road to 2033 Talent Recognised as one of the best cities in the world for global talent, Dubai is top-ranked globally for its friendly visa policies, livability, remote working, and the transparency of its blockchain-powered property market. Like elsewhere, Dubai faces a shortage of AI talent, but organisations in Dubai are taking significant steps to close the skills gap. 3 1st Dubai is ranked as the world’s best city for attracting global talent. Source: Kearney 1st Dubai is ranked as the world’s best city for attracting global talent. Source: Kearney Leadership, Blockchain, Operations, Supply Chain Top skills areas for UAE talent. Source: Coursera Leadership, Blockchain, Operations, Supply Chain Top skills areas for UAE talent. Source: Coursera 1st Dubai is ranked as the easiest place in the world to get a visa. Source: Expat City Ranking 1st Dubai is ranked as the easiest place in the world to get a visa. Source: Expat City Ranking 30

- 32. Dubai Tech: The Road to 2033 Golden Visa 10-year residency visa for property owners, those investing significant capital in the UAE, or entrepreneurs. To qualify, founders must be owners or partners in a pioneering project registered with the Dubai Future Authority, a classified SME, or a project sold for more $1.9m+. Virtual Work Visa One-year visa for remote-work employees who work for a non-UAE company. Applicants must have a monthly income of $3.5k+. Green Visa Five-year residency visa for skilled professionals, freelancers, and self-employed people. Applicants must have university degrees or an equivalent, and meet the relevant income requirements ($98k+ p/a for freelancers/self-employed; $4k+ p/m for skilled professionals). Retirement Visa For those aged 55+ wanting to retire in Dubai. Applicants must own property or have sufficient income or savings. Blue Visa A new 10-year residency visa for individuals who have made an exceptional contribution towards protecting the environment. Applicants must have a verifiable record in climate action, including members of global associations, award winners, and distinguished activists and researchers. Dubai’s friendly visa policies offer significant opportunities for global talent in the region, especially tech founders looking to build and expand their businesses. VISAS Discover more about Dubai visas. 31

- 33. Dubai Tech: The Road to 2033 Steve Papa Founder & CEO Parallel Wireless Founded 2012 Employees 800 Stage Late-Stage Raised $500m+ Parallel Wireless is building a modern cloud-native infrastructure solution for 4G/5G networks. Its ultimate goal is to accelerate 5G capacity globally. Dubai stands out forits talent ecosystem, particularlydue to its proven trackrecord in attracting expatswho arewilling to relocate, drawn bythe emirate'svibrant tech economy. As a regional hub forlarge mobile networkoperatorgroups like MTN, VEON, Airtel, and E&, Dubai has built an impressive talent pool that continues to grow.We are building up a regional HQ team here in Dubai, leveraging these unique advantages. 32

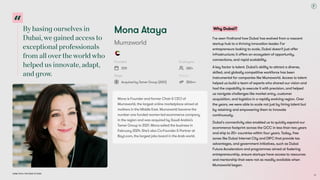

- 34. Bybasingourselvesin Dubai,wegainedaccessto exceptionalprofessionals fromallovertheworldwho helpedusinnovate,adapt, andgrow. Dubai Tech: The Road to 2033 Mona Ataya Mumzworld Founded 2011 Employees 280+ Stage Acquired by Tamer Group (2021) Raised $50m+ Mona is Founder and former Chair & CEO of Mumzworld, the largest online marketplace aimed at mothers in the Middle East. Mumzworld became the number one funded women-led ecommerce company in the region and was acquired by Saudi Arabia’s Tamer Group in 2021. Mona exited the business in February 2024. She’s also Co-Founder & Partner at Bayt.com, the largest jobs board in the Arab world. Why Dubai? I’ve seen firsthand how Dubai has evolved from a nascent startup hub to a thriving innovation leader. For entrepreneurs looking to scale, Dubai doesn’t just offer infrastructure; it offers an ecosystem of opportunity, connections, and rapid scalability. A key factor is talent. Dubai’s ability to attract a diverse, skilled, and globally competitive workforce has been instrumental for companies like Mumzworld. Access to talent helped us build a team of experts who shared our vision and had the capability to execute it with precision, and helped us navigate challenges like market entry, customer acquisition, and logistics in a rapidly evolving region. Over the years, we were able to scale not just by hiring talent but by retaining and empowering them to innovate continuously. Dubai's connectivity also enabled us to quickly expand our ecommerce footprint across the GCC in less than two years and ship to 20+ countries within four years. Today, free zones like Dubai Internet City and DIFC that provide tax advantages, and government initiatives, such as Dubai Future Accelerators and programmes aimed at fostering entrepreneurship, ensure startups have access to resources and mentorship that were not as readily available when Mumzworld began. 33

- 35. Dubai Tech: The Road to 2033 Building in Dubai When Mumzworld launched in 2011, Dubai’s tech and ecommerce ecosystem was in its infancy. Back then, the challenge lay in navigating a market where key enablers such as logistics networks, venture capital availability, and digital payment systems were still evolving. This required ingenuity and resilience. Dubai’s nascent ecosystem, however, also presented an immense opportunity. Its strategic location as a trade and logistics hub was already world-class, and the government was taking its first major steps to foster entrepreneurship. By basing Mumzworld in Dubai, we gained access to its unmatched connectivity across the MENA region, enabling us to rapidly expand across the GCC. Dubai’s free zones also allowed us to operate with agility and handle cross- border complexities efficiently. And funding rounds became relatively easier over time as more VCs and private equity firms set up in Dubai. While Dubai offers infrastructure and support, success still requires a hyper-localized approach. Understanding the cultural diversity and tailoring offerings to meet the unique needs of mothers across the region set Mumzworld apart. From day one, we prioritized operational efficiency – leveraging Dubai’s logistics infrastructure to ensure rapid and reliable deliveries across the region. Another key learning was the importance of staying adaptable. As Dubai’s ecosystem evolved, we continuously integrated new technologies and partnerships. Today, Dubai’s infrastructure is far more sophisticated, and entrepreneurs entering the market benefit from a tech- enabled environment. However, the fundamentals of success – building a world-class team, committing to operational excellence, and deeply understanding your customers – remain unchanged. Advice For Founders Embrace Dubai’s role as a springboard for regional expansion. With its state-of-the-art logistics and infrastructure, you can scale quickly across the Middle East, North Africa, and beyond. For Mumzworld, this was instrumental in becoming a trusted regional leader. Leverage the government’s startup-friendly initiatives, such as access to free zones, zero corporate tax, and accelerator programs like Dubai Future Accelerators. These offer significant operational and financial advantages. Invest in partnerships with local entities. Early on, Mumzworld built relationships with logistics providers and local suppliers to ensure efficiency and customer trust. Collaboration is key in Dubai's interconnected ecosystem. Don’t ignore the importance of market research. Dubai is diverse and serves as a melting pot of cultures, so one- size-fits-all strategies won’t work. Avoid underestimating the competition. Dubai’s appeal means it attracts global tech giants and nimble startups, so differentiation and speed are essential. 34

- 36. UAE'svisionasaglobaltalenthubperfectly mirrorsDeel'smissionofborderlesswork. Dubai Tech: The Road to 2033 Alex Bouaziz Deel Founded 2019 Employees 4,000+ Stage Series D Raised $650m+ Investors a16z, Coatue, Emerson Collective Alex is Co-Founder & CEO of Deel, the all-in-one HR platform for global teams. Deel helps companies simplify every aspect of managing a workforce, from onboarding, compliance and performance management, to global payroll, HRIS and immigration support, and has partnered with the UAE government to attract the best global talent and high-growth companies to the region. 35

- 37. Dubai Tech: The Road to 2033 What’s Next? We’re actively supporting UAE's vision 2031 through HR tech innovation and are facilitating seamless global workforce management under new visa schemes. We see a huge opportunity in supporting companies of all sizes to focus on their core business growth while Deel simplifies their global HR complexities. Advice For Founders Move fast globally while building strong local presence; prioritise relationship building with key stakeholders; foster local partnerships that accelerate growth; align with government initiatives and vision; and build for scale from day one. Why Dubai? UAE consistently ranks among top global destinations for skilled professionals. The government’s progressive policies and digital initiatives like the Dubai Government's D33 create an ideal environment for growth across many industries, which is beneficial for Deel’s objectives of bringing talent to the region and helping companies there hire, pay, and manage their teams. Expanding in Dubai Deel entered in 2021 when UAE was accelerating its digital transformation. Our company’s growth trajectory perfectly complemented Dubai's D33 initiatives. We found strong support for tech innovation and digital economy development and experienced rapid growth supporting both regional and global companies establishing a UAE presence. We certainly recognized the value of the UAE's diverse talent pool and multicultural business environment. I was also personally welcomed with open arms when I was in UAE – I got my visa in under three hours! There was also a great understanding of Deel and how we started, and from the beginning of the relationship I felt a real sense of how we could create value here. 36

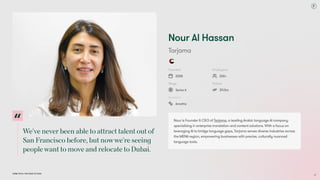

- 38. We'veneverbeenabletoattracttalentoutof SanFranciscobefore,butnowwe'reseeing peoplewanttomoveandrelocatetoDubai. Dubai Tech: The Road to 2033 Nour Al Hassan Tarjama Founded 2008 Employees 200+ Stage Series A Raised $11.5m Investors Amethis Nour is Founder & CEO of Tarjama, a leading Arabic language AI company specialising in enterprise translation and content solutions. With a focus on leveraging AI to bridge language gaps, Tarjama serves diverse industries across the MENA region, empowering businesses with precise, culturally nuanced language tools. 37

- 39. Dubai Tech: The Road to 2033 What’s Next? We have more than 17 nationalities in our company and people distributed across Dubai, Abu Dhabi, and the Middle East and Europe. Now we’re trying to attract the best people to come to Dubai and build a tech talent hub. We’re planning to raise our Series B round early next year and we’re doubling down on AI, focusing on improving our LLM translation capabilities and accuracy and adding more agents to handle specific tasks. Advice For Founders There are multiple funds operating here. You have startup programmes, support from the government, and if you set up your business in a free zone, it’s relatively easy to get your licences approved, your bank accounts set up, and be ready to go in a couple of weeks. At the same time, you need to stay focused when building a business, be prepared to bootstrap, and pivot quickly if there’s no market fit. Once you have enough traction, then you can fundraise. But, at the start, try as much as possible to protect yourself by retaining equity so you avoid diluting yourself and losing leverage over your business. Why Dubai? When you're building an AI company, everyone needs cash. Investors feel more comfortable injecting cash in a business that's operating out of a jurisdiction like the UAE, where there’s good governance and where it’s easy to operate and do business. There’s been a big push around AI and entrepreneurship in the UAE, from setting up AI ministers to 10 year entrepreneur visas, and there’s an attractive ecosystem for talent wanting to relocate. Building from Dubai We’ve fine-tuned an LLM specifically for the Arabic language. We have around 200 employees, we’re in growth stage, and we’re expanding our presence in the AI space. We’ve already expanded in Saudi Arabia and Qatar and now we’re looking to Asia for new markets. We’re seeing more people wanting to relocate to Dubai. It’s a cosmopolitan city and very attractive for foreigners to live in, plus it’s a bridge between East and West, giving you an edge to expand globally from the UAE. 38

- 40. Dubai Tech: The Road to 2033 AI Skills Gap There is huge demand for AI talent across the UAE, but two- thirds of organisations are grappling with a shortage of talent capable of driving innovation in their industries. Meanwhile, 42% of Middle East CEOs report difficulty filling key technology roles. As AI disrupts employee roles and skills, companies in Dubai continue to look abroad to fill talent gaps, but Dubai also needs to build up a local talent pool and reduce dependence on foreign talent. There is a significant talent shortage in climate tech, for example, where the Dubai government has responded with the new 10-year Blue Visa for environmental leaders. Promoting Local Talent Fortunately, the ambition is there. Enrolments in generative AI courses on Coursera in the UAE soared by 1,102% between 2023 and 2024, surpassing growth in the MENA region and globally. And, in May 2024, the University of Dubai and AIJRF launched the first Arab Index for Artificial Intelligence in Universities to monitor and analyse the integration of AI into the curriculum of Arab universities. More broadly, the Dubai-based founders we spoke to say government should promote industry-academia partnerships and invest more in R&D grants and R&D centres that tech companies can potentially hire from. Investing in STEM education from an early age, building the university ecosystem, and adding specialised training programs to train the necessary skilled workforce will be key. Founder Insights 39

- 41. Dubai Tech: The Road to 2033 Capital Dubai is the world’s fastest-growing VC ecosystem, accounting for 30% of all VC rounds raised in the MENA region in 2024, while huge foreign direct investment and rising wealth migration offer founders opportunities to access capital outside traditional VC structures. 4 1,000+ investors with a combined $1 trillion AUM are located in Dubai. Source: Gulf Business 1,000+ investors with a combined $1 trillion AUM are located in Dubai. Source: Gulf Business Fintech, Enterprise SaaS, Transport, Media Industries that have attracted the most VC investment in Dubai between 2023 and 2024. Source: Dealroom Fintech, Enterprise SaaS, Transport, Media Industries that have attracted the most VC investment in Dubai between 2023 and 2024. Source: Dealroom 30% of VC rounds raised in the MENA region in 2024 were raised in Dubai. Source: Dealroom 30% of VC rounds raised in the MENA region in 2024 were raised in Dubai. Source: Dealroom 6,700 millionaires are expected to move to the UAE by the end of 2024 as the country sees a significant rise in HNWI migrations. Source: Henley & Partners 6,700 millionaires are expected to move to the UAE by the end of 2024 as the country sees a significant rise in HNWI migrations. Source: Henley & Partners 40

- 42. Dubai Tech: The Road to 2033 The Dubai tech sector reached a combined market valuation of $43.3b in Q4 2024. The combined value of VC-backed companies headquartered in Dubai has doubled in the past five years and increased by 22x in the past decade. Dubai accounts for 81% of the total value of the UAE tech sector and 34% of the MENA tech sector overall. Despite a normalisation of the VC funding environment after the boom years of 2021 and 2022, the Dubai tech ecosystem is on a significant growth trajectory, new funds are being raised, and there’s huge investment activity, particularly at early stage. VC Investment Trends Combined market valuation of VC-backed companies headquartered in Dubai Source: Dealroom 41

- 43. Dubai Tech: The Road to 2033 Dubai startups have raised $7.3b in VC funding over the past five years, although investment follows a global downward trend in 2024. Dubai-headquartered startups have raised $646m in 2024, compared with a peak of $2.39b in 2022, with VC funding in Dubai following a global downward trend after the boom years of 2021 and 2022. VC investment includes all venture-type investments, from VC firms as well as corporate venture investments and venture investments by family offices, angel networks etc. Note: 2024 figures can be expected to increase slightly. 2024 figures were recorded in November and there is also a known reporting lag for early-stage funding rounds in particular. VC investment in Dubai-headquartered startups Source: Dealroom 42

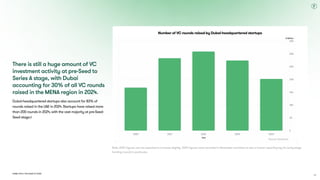

- 44. Dubai Tech: The Road to 2033 There is still a huge amount of VC investment activity at pre-Seed to Series A stage, with Dubai accounting for 30% of all VC rounds raised in the MENA region in 2024. Dubai-headquartered startups also account for 83% of rounds raised in the UAE in 2024. Startups have raised more than 200 rounds in 2024, with the vast majority at pre-Seed- Seed stage.t Note: 2024 figures can be expected to increase slightly. 2024 figures were recorded in November and there is also a known reporting lag for early-stage funding rounds in particular. Number of VC rounds raised by Dubai-headquartered startups Source: Dealroom 43

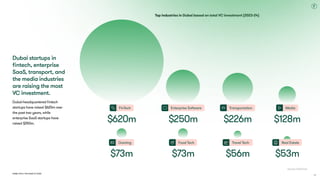

- 45. Top industries in Dubai based on total VC investment (2023-24) Media Real Estate $128m $53m Dubai Tech: The Road to 2033 Dubai startups in fintech, enterprise SaaS, transport, and the media industries are raising the most VC investment. Dubai-headquartered fintech startups have raised $620m over the past two years, while enterprise SaaS startups have raised $250m. FinTech Gaming $620m $73m Enterprise Software Food Tech $250m $73m Transportation Travel Tech $226m $56m Source: Dealroom 44

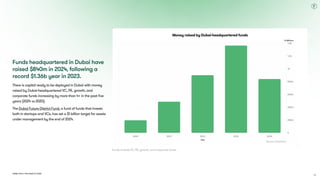

- 46. Dubai Tech: The Road to 2033 Funds headquartered in Dubai have raised $840m in 2024, following a record $1.36b year in 2023. There is capital ready to be deployed in Dubai with money raised by Dubai-headquartered VC, PE, growth, and corporate funds increasing by more than 4x in the past five years (2024 vs 2020). The Dubai Future District Fund, a fund of funds that invests both in startups and VCs, has set a $1 billion target for assets under management by the end of 2024. Funds include VC, PE, growth, and corporate funds. Money raised by Dubai-headquartered funds Source: Dealroom 45

- 47. The UAE presents an incredible opportunity for founders who build with solid unit economics and a clear path to profitability from day one. Dubai Tech: The Road to 2033 Dany Farha BECO Capital AUM $495m Focus Generalist Stage Seed-Series A Ticket Size $2m-$7m Portfolio Includes Abwaab, Careem (Exited), Fresha, Kitopi, Maxab, Property Finder (Exited), Syarah, Thndr 46

- 48. Dubai Tech: The Road to 2033 Expanding in Dubai Leverage the great talent we have here. Dubai has long been a talent magnet and, in recent years, a growth epicentre fueled by decentralised work trends and high quality of life. Don’t import all your executives; having the regional/local lens and reach in the c-suite from someone who has built roots in the region is valuable, and there’s plenty to choose from! Also, visit Dubai and plug into the startup ecosystem. Some may have a misconception that capital comes easy here. Whilst there is a lot of capital, it’s incredibly competitive and the environment in the UAE is unique. For example, the Gulf produces $2.25t GDP with just 60 million people. This low friction presents an incredible opportunity for founders who focus on their unit economics and path to profitability early in their startup journey. We look for founders who can seize the opportunity from day one. Raising Investment We extensively due diligence founders' ability to company build – the ability to hire, fire, inspire others to join their vision, and think about what their business needs well beyond the round they’re raising. We are company builders ourselves; we go extremely deep with founders during DD and hope they see the value we can bring as investors, and how that will be accretive to their business in the long run. Learning and adapting is crucial. Our best founders listen to the market and pivot when needed; they don’t get stuck on a model or product when it's not working. The dynamics of this region also lend themselves to building capital efficient businesses. Lastly, in the age of AI, it is imperative to have a proprietary data advantage. Click here to read more. Investment Trends The UAE continues to be a core market for us and is around 50% of our target geography in the current fund. We have identified four high-conviction sectors, all underpinned by an AI layer and key founder or business model characteristics including capital efficiency and intelligent use of proprietary data. We're especially excited about PropTech and Construction-Tech; these sectors are nominally large and rapidly growing, and in Dubai, companies can build innovative models on top of the strong digital foundation built by players like PropertyFinder. Another is Lending; specifically profitable lending driven by AI/ML and an unfair data advantage, meeting strong demand for consumer and business lending solutions. We've made investments in vertical lending, such as RNPL, and SME lending. The strength of the Gulf consumer is extremely powerful, high APRU and mix of online and offline shopping environments create an ideal landscape for omni- channel brands. Retail Tech and Consumer Brands like Eyewa and Kitopi have capitalised on this, and we believe there's room for more standout omnichannel tech-enabled consumer or retail brands. And we’re closely monitoring the AI space. We believe the region will play a notable role on the global AI stage, particularly with the tech talent migrating here, and that there may be exciting opportunities within the life of Fund 4. 47

- 49. Do your investor due diligence and strategically approach the investors you feel provide the best value and support as well as capital. Dubai Tech: The Road to 2033 Sonia Weymuller VentureSouq AUM $250m+ Focus Climate Tech & Fintech Stage Seed-Series B Ticket Size $500k-$5m Portfolio Includes Andela, Aspire, Bikayi, Bikry, Clara, Eyrv Health, Huspy, Impossible Foods, Jeeves, Mighty Buildings, Odeko, Onfido, Reddit, Seafood Souq, Substack, Tabby, Telegram, Zoomcar 48

- 50. Dubai Tech: The Road to 2033 Expanding in Dubai Reflect on what your contribution will be to the region. Do your research, gain an understanding of the legal and regulatory requirements depending on the sector you are in, delve into the various set up options, spend time here building your local network from investors to other founders and ecosystem builders, and keep a pulse for regional initiatives, announcements, and sector-specific opportunities. Raising Investment It's tempting to widen your target investor list when faced with a challenging fundraising environment; some would go as far as randomly cold messaging any and all investors irrespective of what mandates these investors actually have. However, I encourage international founders looking at expansion to the region to do their own investor diligence and strategically approach regional investors they feel would best provide the value, the guidance and the support they need, in addition to the capital. Making sure you are approaching the relevant investors in a targeted way will save you time – focus on quality of approach over quantity. Investment Trends We manage a thematic VC platform focused on fintech and climate. The need for an uplift in terms of financial services in MENA, and the recognition of how much venture needs fintech as a building block, became increasingly apparent to us over the course of our journey. We invested alongside some of the biggest global VCs into a number of high-profile fintech companies and we developed a strong conviction that fintech would ultimately serve as unifier for a still very fragmented regional market. This led to our launching the first sector focused fund backed by regional sovereign powerhouses including PIF’s Jada Fund of Funds, Mubadala, ADQ, and Bahrain’s Al Waha Fund of Funds. At the same time, we also recognised that the new economy will inevitably need to incorporate climate considerations at its core and all stakeholders need to be building the foundations for this now. Specifically, we believe that MENA, as a region that is both uniquely vulnerable to, but also well equipped to counter climate change, should take a leadership role in the global climate effort. We have been actively investing in this space for the last five years and will continue to do so with a current focus on the MENA-Asia climate corridor. 49

- 51. Dubai Tech: The Road to 2033 Wealth Migration An estimated 6,700 millionaires relocated to the UAE in 2024, driven by an influx from the UK and Europe, according to Henley & Partners’ Wealth Migration index. 2024’s net millionaire inflow to the UAE is nearly double that of its closest competitor, the US, which was projected to welcome around 3,800 millionaires. Dubai alone is home to more 72,500 millionaires – 212 with $100m or more, as well as 15 billionaires – fuelling the rise of the city’s wealth management industry. More than 300 wealth and asset management firms accounting for $500b AUM have set up operations in the DIFC, including Edmond de Rothschild, EnTrust Global, and Nomura. Dubai-based family offices manage more than $1 trillion in assets. As the world's leading wealth magnet, home to many of the world’s millionaires and one third of all MENA investors, founders in Dubai can tap into an array of funding opportunities beyond traditional VC investment. Global Investment Opportunities Jack Hidary (SandboxAQ) 50

- 52. Dubai Tech: The Road to 2033 FDI Dubai has been ranked first globally for attracting greenfield foreign direct investment for three consecutive years. In H1 2024, Dubai attracted 508 greenfield foreign direct investment projects, representing a 6.2% global share and an 8% increase on the previous year. The majority of FDI projects are focused on high-tech investment and building Dubai’s digital economy. Between 2022 and 2023, the Middle East was the only region in the world that saw growth of tech FDI projects, and Dubai attracted more than half of those projects in 2023. Public Markets In November 2024, UAE-listed stocks surpassed $1 trillion in value for the first time. The Dubai Financial Market is ranked among the top 10 IPO destinations in the world and has seen steady growth in IPOs in recent years, most notably the public listings of DEWA, Empower Salik, and Al Ansari Financial Services. German multinational tech company, Delivery Hero, is also reportedly planning for an IPO of its Emirati subsidiary, talabat, the Emirati subsidiary of German multinational tech company, Delivery Hero, went public with a $2b IPO on the Dubai stock exchange in December 2024. Cindy Mi (VIPKID) 51

- 53. We’remostexcitedaboutsupplychain disruption,manufacturing,andthewhole areaoffoodsecurity. Dubai Tech: The Road to 2033 Noor Sweid Global Ventures AUM $350m Focus Generalist Stage Series A Ticket Size $5m-$10m Portfolio Includes ABHI, Hakbah, Moniepoint, Immensa, iyris, Maalexi, Proximie, Seafood Souq 52

- 54. Dubai Tech: The Road to 2033 Expanding in Dubai Understand what real market needs your solution solves. Tabby is a great example. In Europe or the US, credit card penetration is already high, people have access to digital payments, and Buy Now Pay Later doesn’t solve a big problem, so a lot of companies doing BNPL have failed. In the Middle East, BNPL solves the real pain point of lack of access to credit and lack of digital payment solutions. As you're looking to expand here, take a moment to reflect and analyse whether this market really does need your product or solution and how you can adapt it so it's solving a real market problem. Raising Investment The VC ecosystem in Dubai is young and growing very quickly. Find investors who are strategic, understand what you’re building, and can be supportive. Investment Trends In manufacturing and agritech, you don’t have many incumbents or legacy infrastructure in our region – and so when founders start companies, they can really scale. You get companies like Immensa, a 3D printing company that’s digitising the global spare parts supply chain and using additive manufacturing to solve real problems. They’re scaling without the challenge you’d face in Europe or the US from traditional manufacturing incumbents. In AI, we’re investing in AI-led companies that are solving real problems, rather than the deep tech of AI that’s being built. Like blockchain before it, AI is fast becoming an enabling technology that you need to use because if you don’t you’ll be at a competitive disadvantage. Now, all the world is building better and smarter LLMs. But, in our region, we want use cases. We want to know how to use AI to make ecommerce better, make our population smarter, or widen access to healthcare. 53

- 56. Dubai Tech: The Road to 2033 Expanding in Dubai When expanding in Dubai, a deep comprehension of local market dynamics, cultural nuances, and consumer behaviour is crucial. Companies that tailor their offerings to meet regional needs and, beyond that, the country they are operating in, stand out. While the Middle East can be grouped as a region, there are vast differences between the UAE and Egypt or Saudi Arabia. A deep understanding of those structural differences is critical, and the ability to scale across the Middle East and Africa is a significant advantage. Solutions that address common challenges across multiple markets are particularly attractive. Raising Investment Develop a deep understanding of the country and specific nuances. Expand with the intention to build commercial and local partnerships and fully service the market – the capital will follow As fintech investors, regulation also plays a massive role in our day to day. Working with a founding team that understands how to navigate the regulatory landscape effectively is essential. We look for startups that proactively engage with regulators and consider them as allies. Investment Trends The biggest investment opportunities in Dubai fall in line with Dubai’s strategic initiatives, which include driving the adoption of digital financial services (fintech), enhancing the efficiency of the thriving real estate market (proptech), and the circular economy. At Speedinvest, we invest across six verticals in Europe. What few people know is that we have also been building a portfolio of fintech and fintech-enabled startups in Global Growth Markets with rapid population and GDP growth. We have invested in 29 fintech and fintech-enabled companies across LATAM, Africa, Middle East, Pakistan, and Bangladesh. Over half of those companies are in the Middle East and Africa, and we’re building a fintech team in the UAE to cover the region. Today, the majority of the SMB population in the region is not being addressed and that’s a segment that we’re extremely interested in. We look at startups that service SMEs/SMBs whether through expense management, lending, payments, as a pure fintech vertical. We are also interested in how this segment can be serviced indirectly through embedded finance so fintech as a horizontal especially in B2B segment. 55

- 57. Dubai Tech: The Road to 2033 Scaleup Capital Despite a healthy investment ecosystem, founders in Dubai are increasingly searching for growth funding opportunities as they scale their businesses. Of the 273 rounds raised by Dubai-headquartered startups in 2023, just 4 (1.5%) were Series C-type rounds or later (worth $40-$100m), according to Dealroom. No Dubai-headquartered startup raised a round worth more than $100m. As the Dubai startup ecosystem grows, it’s vital that growth- stage companies can continue to attract funding to support their scaling journey. For later-stage companies, greater flexibility around IPO eligibility rules focused on profitability would also enable more tech companies to go public in Dubai. Funding Women Founders Like elsewhere, the share of VC funding raised by Dubai startups with women founders or co-founders tracks is low, but Dubai is taking steps to increase opportunities for women founders. The Dubai Business Women Council is dedicated to the professional and personal growth of businesswomen and female entrepreneurs in the UAE, while Dubai’s SheTrades Hub serves as a resource centre for women entrepreneurs in the region, offering skills training, resources, and market access opportunities, to help them scale up their businesses. Founder Insights 56

- 58. Dubai Tech: The Road to 2033 Access to Growth Markets With easy access to fast-growing markets across the MEASA (Middle East, Africa, and South Asia) region, founders are expanding internationally and building global businesses from Dubai. 5 $7.7 trillion Combined GDP of MEASA countries. Source: Innovate Finance $7.7 trillion Combined GDP of MEASA countries. Source: Innovate Finance +51% Rise in GDP between 2002 and 2022. Source: Transition Investment Lab +51% Rise in GDP between 2002 and 2022. Source: Transition Investment Lab 1st Dubai International Airport has been ranked the world’s number one for international passengers for 10 consecutive years. Source: ACI 1st Dubai International Airport has been ranked the world’s number one for international passengers for 10 consecutive years. Source: ACI 57

- 59. Dubai Tech: The Road to 2033 Sub-Saharan Africa By 2030, every $1 invested in digital technology in Sub-Saharan Africa will return over $2 for the region's wider economy. Overcoming key connectivity barriers could unlock $170b in GDP. Dubai-headquartered companies are ideally positioned to tap into the high- potential region. In October 2024, cybersecurity company, PROW, announced plans to boost its expansion in Africa, in a cybersecurity market expected to exceed $3.7b by 2025. Dubai’s DP World plans to spend $3b on new port and logistics infrastructure in Africa by 2029. Pakistan In May 2024, the UAE announced a $10b investment in promising economic sectors in Pakistan and has strategic partnerships across the technology, renewable energy, and tourism industries. India In May 2022, the UAE and India signed the Comprehensive Economic Partnership Agreement (CEPA) to increase bilateral trade in goods to $100b, and services to $15b, within five years. The agreement reduces or eliminates tariffs on more than 80% of product lines. MEASA is home to more than half the world’s population; four billion people with a median age of less than 24 years old, spread across 88 countries with a combined GDP of $7.7 trillion. Dubai offers a gateway to this rapidly expanding region. Nigeria Africa' richest man, Aliko Dangote, has announced plans to establish a family office in Dubai. South Africa There are more than 2,400 South African companies affiliated or registered with the Dubai Chambers of Commerce. Dubai The world’s busiest airport for international passengers, Dubai International Airport is connected to 273 destinations in 105 countries through more than 100 airlines. The Port of Jebel Ali is one of the world's ten busiest ports and the largest container port in the Middle East. Part of the D33 Agenda, the Dubai Economic Corridors 2033 initiative is designed to enhance foreign trade with cities across Africa, Latin America, and Southeast Asia. 58

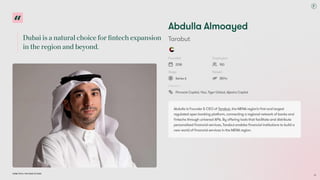

- 60. Success here comes from being genuinely engaged with the ecosystem and understanding how your business can contribute. Dubai Tech: The Road to 2033 Sachin Dev Duggal Builder .ai Founded 2016 Employees 800+ Stage Series D Raised $450m+ Investors Qatar Investment Authority (QIA), Iconiq Capital, Jungle Ventures, Insight Partners Sachin is Founder & Chief Wizard at Builder .ai, the AI-powered composable software platform that allows every business to become digitally powered. 59